×

The Standard e-Paper

Stay Informed, Even Offline

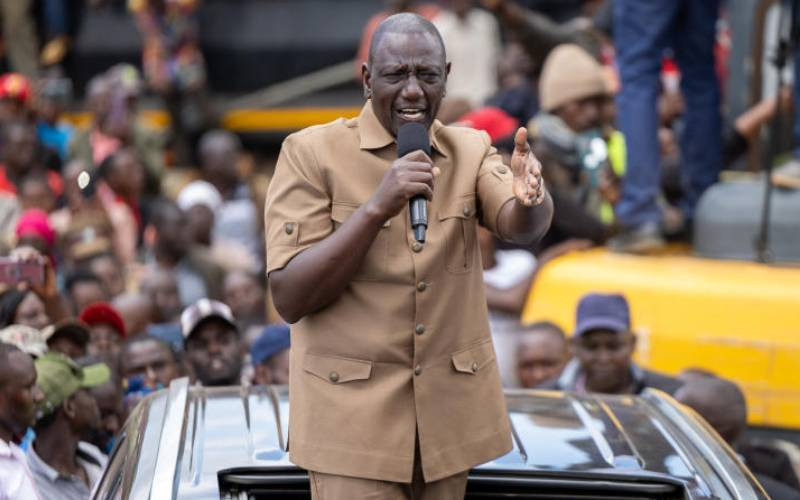

The banking regulator has dealt a massive blow to President William Ruto's ambitious dream of offering cheap credit to businesses and individuals, a year and four months into his presidency.

Borrowers are staring at expensive loans after the Central Bank of Kenya (CBK) increased its benchmark lending rate by 50 basis points to 13 per cent.