The current game in town is guessing the next level of the shilling, which has appreciated fast and furiously. It's made more exciting by the Central Bank of Kenya (CBK) not giving the targeted exchange rate.

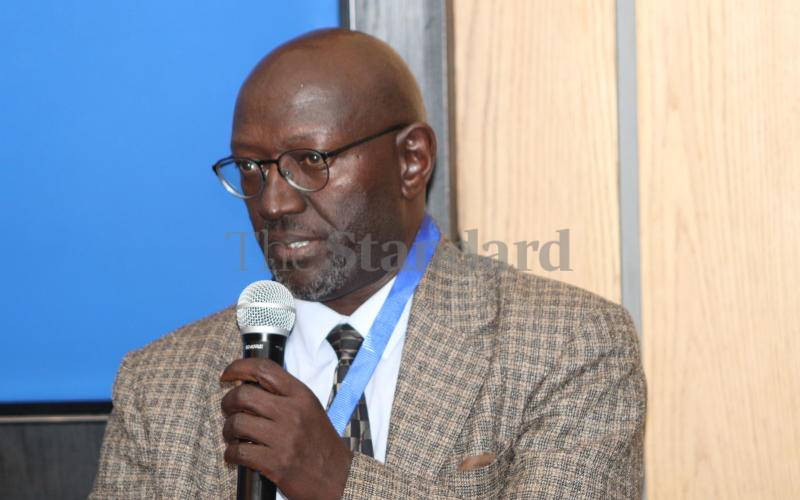

Economists, pseudo-economists, prophets, and naysayers are all trying to explain the sudden appreciation. The beauty of all this is that, in the fullness of time, the truth shall emerge when more information is made available, most likely in drips. Let me try to explain the surge using economics, psychology, and speculation.

First, the surge in the Kenyan shilling does not seem to follow the fundamentals, the laws of supply and demand. There has been no significant inflow of dollars in the market, and there has been no major global event like the US cutting interest rates.

Second, we are made to believe that the successful buying back of Eurobond made the shilling appreciate. The argument is that the expected inflow of dollars would create demand for the shilling and force it to appreciate. But buying back Eurobond led to no inflow of dollars; we are buying cheap debt at a higher price, which should even lead to topping up, resulting in an outflow.

However, we can't discount the confidence in the market that the government will not default. But the high rate for the new Eurobond shows that confidence is muted. Is this an example of irrational exuberance, to quote Alan Greenspan, the former US Federal Reserve Board (Central Bank) Chair?

Third, there has not been any surge in exports to bring in lots of dollars. Imports have decreased because of an expensive dollar, but not enough to make the shilling surge. Was there any major Foreign Direct Investment (FDI)? The bonds on sale could not have brought enough dollars to affect the shilling that significantly.

Fourth, some have suggested that the Chinese New Year holiday is to blame, as the demand for the dollar went down due to reduced economic activities. But why did the shilling not surge during other Chinese holidays? Why now?

Fifth, others attribute the surge to a Government-to-Government (G2G) oil deal. But the government recently reported that it was not successful.

Sixth, was the surge a result of the hike in interest rates? It can't be, as we could have seen it after an increase of 2 percent, not half a percent.

The harder we look for an explanation for the surge of the Kenyan shilling, the more the explanation recedes like a rainbow. Maybe we are looking for the explanation in the wrong place; maybe it's right here.

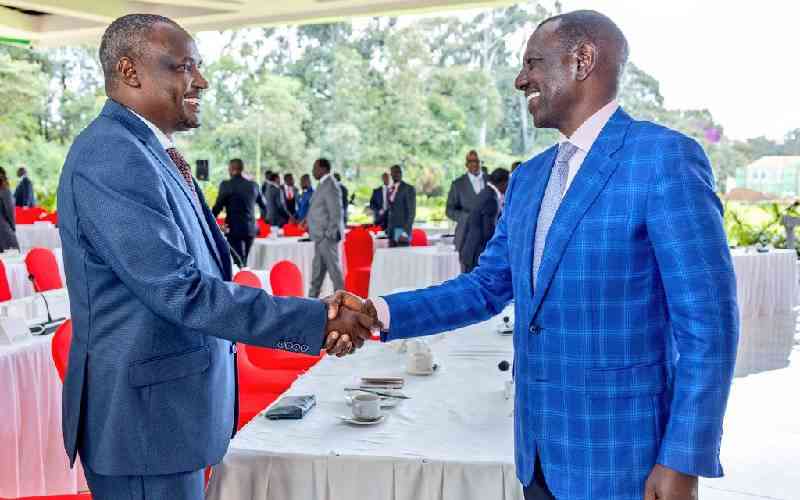

Recently we heard the president say the shilling will appreciate to a level not seen before. His deputy even told Kenyans to sell their dollars before they lose more value. Get where I am going?

Once the shilling gained marginally against the dollar, after the Eurobond was settled, someone realized you can build on that momentum. Give credit where it is due; that was clever and strategic.

By declaring that the shilling will appreciate, it appreciated, and the market reacted. Remember a self-fulfilling prophecy? Dollars started flooding the market before they lost more value. There was a race to the bottom. Where did the dollars come from?

Let's use an example from the vegetable market. A cabbage goes for 100 Ksh. Someone then spreads a rumor that 10 truckloads of cabbages are arriving from Uganda by evening. How do you react? Sell your cabbages as soon as possible before prices collapse. But you are not alone. To undercut others, you lower the price further. Others do the same.

What if the rumor is confirmed as just that? The losers will have lost. It's possible someone could buy the cabbages at a lower price and sell them at a higher price once the market recovers from the rumor! Your Comparison and Contrast Task (CAT): compare and contrast the dollar and cabbage markets (5 marks).

The other local explanation emanated from the CBK governor. He said the shilling had overshot short of its equilibrium value, and there was scope to support the exchange rate. Is that what he did? Did CBK flood the market with dollars? Where from, when we just have enough dollars to cover the optimal import cover of 4 months? Is this the invisible hand in the shilling surge, or is there another hand?

Let me add a spin to the surging value of the Kenyan shilling. Why did the jokes on the depreciating dollar target one specific bank? Why are other East African currencies not behaving "abnormally"? Did the Nairobi Securities Exchange (NSE) index react to the shilling surge?

Yet another spin: our political leaders boldly suggested that the shilling would appreciate. Why did they not successfully predict the fall in the price of basic commodities? And why was the shilling allowed a free fall when it could be reversed?

Did I hear that we are celebrating the surging shilling to preempt the pain soon emanating from the new SHIF levy? A strong shilling will reduce our debt burden - we can genuinely celebrate that. What else is there to?

Finally, what will be the equilibrium exchange rate of the Kenyan shilling? Until we fully understand the recent appreciation, we cannot accurately predict the equilibrium value. My speculation is that whoever or whatever contributed to the recent surge knows the equilibrium price.

We hope the targeted exchange rate will stabilise the market and have a tangible impact on all Kenyans, resulting in lower inflation and faster economic growth. I estimate the equilibrium rate to be within the range of 135-150. Any value outside this range would be considered a statistical anomaly.

The Standard Group Plc is a multi-media organization with investments in media platforms spanning newspaper print

operations, television, radio broadcasting, digital and online services. The Standard Group is recognized as a

leading multi-media house in Kenya with a key influence in matters of national and international interest.

The Standard Group Plc is a multi-media organization with investments in media platforms spanning newspaper print

operations, television, radio broadcasting, digital and online services. The Standard Group is recognized as a

leading multi-media house in Kenya with a key influence in matters of national and international interest.