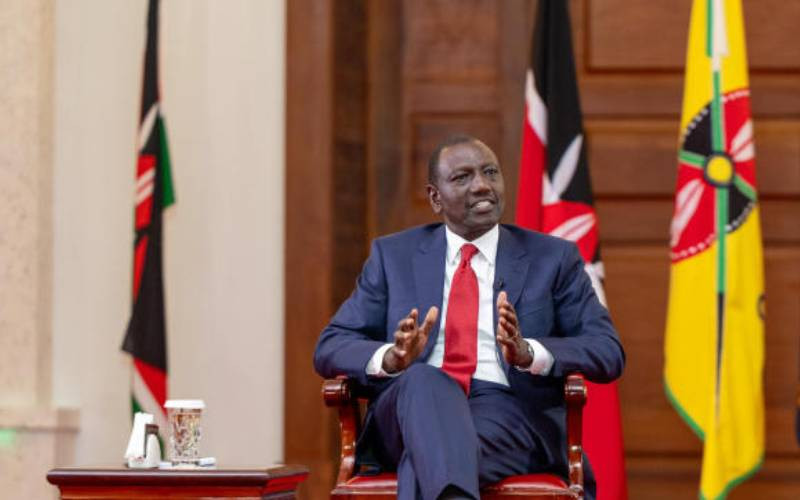

The President’s recent visits abroad to woo investors and bring the much-needed financial resources to Kenya are welcome.

It is the responsibility of every visionary leader to place the country in the international market as a reliable centre of investments. However, economic growth, while it is pivot of prosperity, cannot be realised without enabling governance environment.

The focus should to be deal with internal imperfections that might hamstring the realisation of Kenya's potential as an investment destination.

Kenya brags to be one of the best investment destinations due to its stability and the skilled human capital compared to its peers in the sub-Saharan region. However, it seems to be losing its place as the most attractive investment destination. A country like Rwanda is doing better in all indicators, according to the World Bank’s Ease of Doing Business.

Challenges in governance greatly affects a country’s economic growth. The ubiquitous corruption, poor service delivery in the public sector, high and punitive taxation remain the Achilles heel to Kenya's growth and prosperity. Kenya should address corruption to boost and sustain its attractiveness to foreign investment and aid.

In The World Bank’s Doing Business Report of 2020, Kenya is ranked behind Mauritius and Rwanda in the sub-Saharan region. While Kenya has implemented reforms to boost its standing, there are still critical areas that need to addressed. For instance, one has to go through ten procedures to register property. This is above the regional average of six procedures.

In this indicator. Kenya is ranked 134th out of 190 countries and scored 53.8 per cent against the regional average of 53.6. Other areas are enforcement of contracts and ease of importing goods across the borders. In the former, the country has an average score in quality of judicial process index and the cost of claims is slightly higher than the regional average.

Further, in the National Ethics and Anti-Corruption Survey of 2022 by the Ethics and Anti-Corruption Commission, 70 per cent of the respondents perceived corruption levels to be high. Of concern to the Kenyans is that corruption hampers economic growth. In addition, the survey revealed that Kenyans encountered the highest occasion of bribe demands in seeking services like getting business permits and registration of business. Both services are essential to investors.

According to the Global Financial Integrity (GFI), Kenya’s inclusion in the Financial Action Task Force’s grey list in February 2024 might affect the country’s push to attract foreign aid and investment. The major reason for the grey listing was the lack of clear strategies in the enforcement of anti-money laundering and Counter Terrorist Financing laws and regulation.

These, according to experts, could increase the cost of compliance for financial institutions and business in grey listed countries to access the global markets since compliant countries (white list) will place stricter compliance rules on grey-listed countries like Kenya.

While the move to bring investors and resources is very strategic, the real issue should be what is being done to prepare the ground for sustained growth and development. The lapses in governance will adversely affect the realisation of the dream. Kenya needs to address endemic corruption and poor service delivery as a matter of priority to make it more attractive.

The policymakers should direct their energies in providing the necessary reforms and strengthening governance institutions so as to restore the trust and confidence of the public and investors. The areas of concern should be reforming the public sector service delivery, strengthening the enforcement of anti-corruption and money laundering laws, reform the Judiciary and implementing investment-friendly taxation policies to provide the necessary incentives.

The Standard Group Plc is a multi-media organization with investments in media platforms spanning newspaper print

operations, television, radio broadcasting, digital and online services. The Standard Group is recognized as a

leading multi-media house in Kenya with a key influence in matters of national and international interest.

The Standard Group Plc is a multi-media organization with investments in media platforms spanning newspaper print

operations, television, radio broadcasting, digital and online services. The Standard Group is recognized as a

leading multi-media house in Kenya with a key influence in matters of national and international interest.