×

The Standard e-Paper

Join Thousands Daily

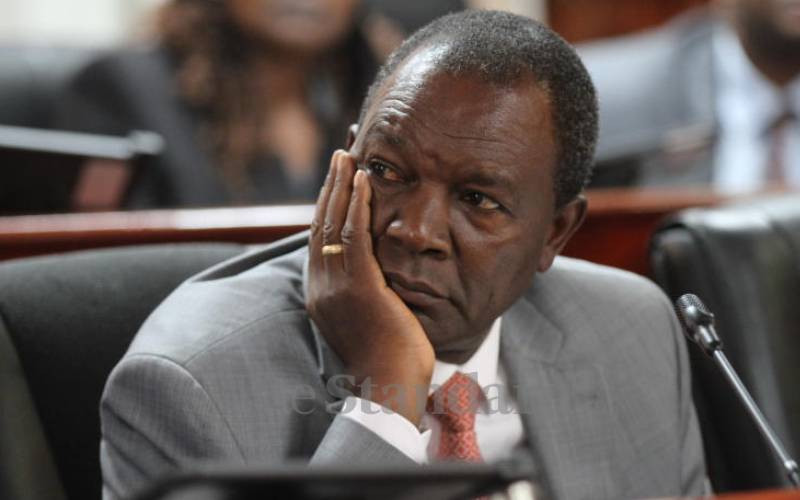

A battle royale awaits the tabling in Parliament of the 2023/24 budget proposals by Finance Cabinet Secretary Njuguna Ndung'u on June 15, unless a way out is found before then.

Opposition legislators have their guns already drawn and blazing, and are digging in for a fierce battle of wits on the floor of the two houses.