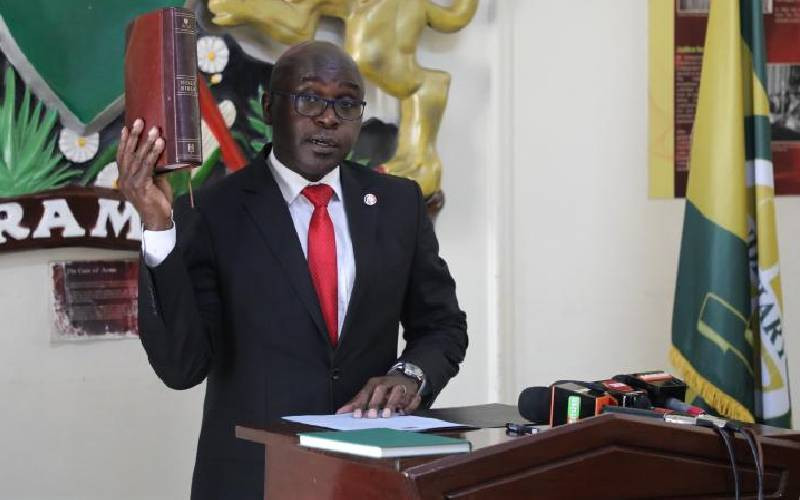

Kenya Revenue Authority (KRA) Commissioner-General Humphrey Wattanga is in the cross hairs of MPs over the government’s alleged loss of Sh62 billion through tax evasion by Louis Dreyfus Company (LDC) Asia PTA limited and Louis Dreyfus Company Kenya (LDC) limited.

According to documents tabled in Parliament, the tax evasion was orchestrated through mis-declaration of palm oil cargo imported by the companies within three years.

The Finance and National Planning Committee has summoned Wattanga with the intent of getting to the bottom of the matter and is required to appear before the committee to provide information vital to the MPs inquiry.

“From the foregoing and the importance of revenue mobilization in the country, the Committee resolved to invite you for a meeting to shed light on the matter,” reads a letter from letter by Senior Deputy Clerk Jeremiah Ndombi on behalf of the Clerk of the National Assembly Samuel Njoroge.

The documents before the House team, indicate that the product imported by LDC companies whose intended use is in Kenya and the other East African countries using the port of Mombasa, was mis-declared in two ways.

First, the product came as a blending of 60 per cent crude palm oil with refined palm oil of 40 per cent, which was then declared as crude palm oil. On the other hand, the product was imported in refined form but declared as crude palm oil at the port of Mombasa so as to evade the 35 per cent import duty or USD500 charged per ton.

The product also attracts Import Declaration Fee (IDF) at the rate of 2.5 per cent, Railway Development Levy of 1.5 per cent and Value Added Tax (VAT) 16 per cent.

Notably, in Kenya, 35 per cent duty is charged on imported refined palm oil with semi refined palm oil attracting 10 per cent duty.

The Kimani Kuria-led wants Wattanga to furnish it with documents indicating the total cargo volume of oil imported by LDC Asia PTA through the port of Mombasa from February 23, 2023 and June 26, 2024.

“The details should include the volumes of RBD Palm Stearin, Crude Palm Kernel Oil, Crude Palm Olein, Crude Palm Oil, and Crude Palm Fatty Acid Distillate,” adds the letter.

The KRA Chief is also expected to provide details on the total taxes and fees paid by LDC Asia PTA in the importation of the palm oil cargo from February 23, 2023 and June 26, 2024.

He is also required to provide copies of import declaration documents encompassing health reports, Kenya Bureau of Standards reports, bills of ladings and cargo manifests for all the 120 cargo of palm oil imported by the company from February 23, 2023 and June 26, 2024.

A list of consignees of all the palm oil cargo volumes imported by the company during the period as well as details of cargo volume of RBD Palm Stearin, Crude Palm Kernel Oil, Crude Palm Olein, Crude Palm Oil, and Crude Palm Fatty Acid Distillate imported by LDC- Kenya limited, Acee Limited, Mazeras Oil Limited and Vipingo Industries Limited through the port of Mombasa from February 23, 2023 and June 26, 2024 are also required.

Moreover, Wattanga has been compelled to provide details of the taxes and fees paid by LDC- Kenya limited, Acee limited, Mazeras Oil limited and Vipingo Industries limited in the importation of the palm oil products between February 23, 2023 and June 26, 2024.

The Standard Group Plc is a multi-media organization with investments in media platforms spanning newspaper print

operations, television, radio broadcasting, digital and online services. The Standard Group is recognized as a

leading multi-media house in Kenya with a key influence in matters of national and international interest.

The Standard Group Plc is a multi-media organization with investments in media platforms spanning newspaper print

operations, television, radio broadcasting, digital and online services. The Standard Group is recognized as a

leading multi-media house in Kenya with a key influence in matters of national and international interest.