Kenyan protesters have forced President William Ruto into a U-turn on tax hikes after the initially peaceful rallies turned violent, with more than 20 people killed and parliament ransacked.

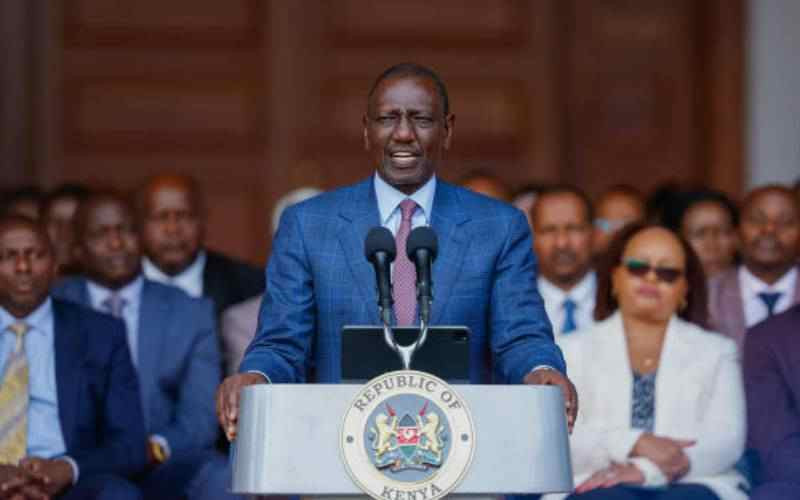

On Wednesday, Ruto said he would "listen to the people" and declined to sign the tax increases into law, kicking the contentious finance bill back to parliament with all clauses deleted.

The decision was a victory for the mostly Gen-Z demonstrators, but where does it leave the economy? And what options does Ruto have now?

What sparked the protests?

The government was taken by surprise after small rallies against tax increases in the annual finance bill gathered momentum, with thousands marching.

Tensions escalated in several cities, with the capital Nairobi witnessing the worst of the violence, when 19 protesters were killed and a partly ablaze parliament was ransacked.

A conciliatory Ruto then addressed the nation and pulled the plug on the increases.

What was in the finance bill?

The four-trillion-shilling ($31.1-billion) budget was the biggest in Kenya's history and included tax increases on basic necessities such as bread and fuel.

Demonstrators said the measures would hit the poor and working class, already struggling with a biting cost-of-living crisis.

But Ruto and his government defended the move, which would have raised some $2.7 billion in additional taxes, as necessary to cut debt.

How bad is Kenya's debt?

Bad. Kenya's total public debt amounts to some 10 trillion shillings, around 70 percent of GDP.

Servicing debt dominates government spending. Treasury data in April showed the government spent roughly 1.2 trillion shillings to service debt between July 2023 and March 2024, compared to some 1.1 trillion on salaries and development projects -- such as roads, healthcare, education and other vital infrastructure.

According to UN Trade and Development figures in 2021, Kenya spends 4.4 percent of its GDP on education and just 1.9 percent on health.

The majority of the debt is foreign held, with bodies such as the International Monetary Fund urging Nairobi to implement fiscal reforms.

So what happens now?

Oxford Economics said in a note that Nairobi would have to strike a balance between "a populace willing to resort to violence to protect livelihoods, and a macroeconomic trajectory that, bar considerable multilateral support, is heading towards a cliff."

Ken Gichinga, chief economist at Mentoria Economics, told AFP that Kenya had spent a record 1.86 trillion shillings on servicing the debt this fiscal year.

The government needs to tread a fine line between making budget cuts and stimulating the economy, he said, keeping the deficit under control and not letting already high inflation -- a key complaint of the protesters -- spiral.

"The leadership is between a rock and a hard place, where the foreign lenders really care about debt sustainability but the citizens want jobs," Gichinga told AFP.

What has Ruto proposed?

There are few details of what may replace the bill.

Ruto on Wednesday emphasised that austerity measures would be required, noting there would be less funding for teachers and development programmes.

The move may pacify critics appalled at what they say is his administration's profligate spending, which in one case included Deputy President Rigathi Gachagua splashing out some 10 million shillings on curtains for his office.

Gichinga said it was unclear whether the cuts would focus on "excessive spending" or critical services.

Ultimately, he said, "the IMF's primary focus is on debt sustainability, but the country has to deliver on jobs for its people."

The Standard Group Plc is a multi-media organization with investments in media platforms spanning newspaper print

operations, television, radio broadcasting, digital and online services. The Standard Group is recognized as a

leading multi-media house in Kenya with a key influence in matters of national and international interest.

The Standard Group Plc is a multi-media organization with investments in media platforms spanning newspaper print

operations, television, radio broadcasting, digital and online services. The Standard Group is recognized as a

leading multi-media house in Kenya with a key influence in matters of national and international interest.