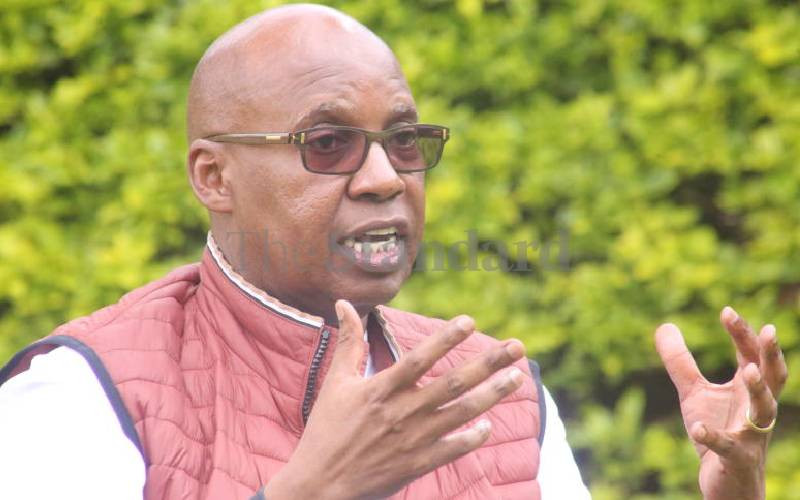

As President William Ruto’s government intensifies efforts to increase state revenue, Safina Party leader cum businessman Jimi Wanjigi is calling for a tax revolt among Kenyans arguing it is the only way to cripple the Kenya Kwanza regime.

This comes at a time when the country’s tax collector, Kenya Revenue Authority (KRA) is reporting a slight increase in revenue collection, compared to the same period last year.

In an interview on Spice FM yesterday morning, Wanjigi questioned the importance of filing nil returns urging young unemployed Kenyans to shun filing tax returns.

This is contrary to a requirement by KRA, which penalises Kenyans who fail to file nil returns. “How do they file returns when they’ve been unemployed? That is how ridiculous it is,” Wanjigi said.

“This is part of civil disobedience. Stop telling us to conform. We are objecting to this nonsense, because it is part of conditioning us, dominating us and extracting from us,” he added.

Not once or twice, he has consistently faulted Ruto’s era for what he terms as ‘enticing the public with false promises’, such as the hustler narrative and the supposed over taxation.

In October this year, reports of KRA integrating its systems with banks, money remittance firms and telco’s providing payment services to identify tax evaders emerged. This was after the taxman sent letters to concerned CEOs demanding links to their firms.

Seemingly angered by KRA’s increased use of data and linkages between its systems with third parties, Wanjigi urged Kenyans to embrace cash transactions without any data in what seemed like advocacy for tax evasion and avoidance.

“I want to encourage people to get off the grid. Get off your M-pesa. Get off your paybills,” he suggested.

In the last few months, President Ruto’s regime has faced a spate of opposition stemming from the anti-Finance Bill, 2024, that led to protesters making their way into Parliament in a bid to stop lawmakers from passing the controversial Bill over high taxation.

The Government has had to withdraw, re-look some of its policies and decisions and call for suggestions from Kenyans as majority of online users and opposition leaders continue to call for the exit of the Head of State.

In line with the recent happenings, Wanjigi wants Kenyans to stop remitting their taxes saying it is the only way to ensure the incumbent regime exits. “There are two causes of action that we must own, because it’s not enough to just say ‘Ruto must go’. We must make it happen. The first is, since we are in a revolutionary moment, we must take hold of the revolutionary moment with action we are going to soon be proposing, tax revolution,” he said.

“We will soon be proposing a tax revolution. Stop feeding this person you want to go. Stop paying tax. Those revolutions have worked since time immemorial. Stop paying tax,” he added.

Following the launch of Social Health Insurance Fund (Shif) in October and the courts legalising the housing levy, salaried Kenyans have decried extra deductions from their income as they have to take home less money.

Wanjigi said employees give almost 70 per cent of their income to taxes. He made a comparison to first world countries where taxation is high, but argued that services are top-notch. “The maximum Pay As You Earn (PAYE) rate is 35 per cent then you have the National Social Security Fund (NSSF), which takes six per cent of employees’ income, affordable housing takes another 1.5 per cent then Shif takes 2.7 per cent. So the total direct taxes are 45.2 per cent. Then you have indirect taxes of about 24.66 per cent on consumables, VAT excise on money transfers, import duties, railway levy, among others. Literally, close to 69 per cent of your earned revenue is going to taxation,” Wanjigi said.

The Standard Group Plc is a multi-media organization with investments in media platforms spanning newspaper print

operations, television, radio broadcasting, digital and online services. The Standard Group is recognized as a

leading multi-media house in Kenya with a key influence in matters of national and international interest.

The Standard Group Plc is a multi-media organization with investments in media platforms spanning newspaper print

operations, television, radio broadcasting, digital and online services. The Standard Group is recognized as a

leading multi-media house in Kenya with a key influence in matters of national and international interest.