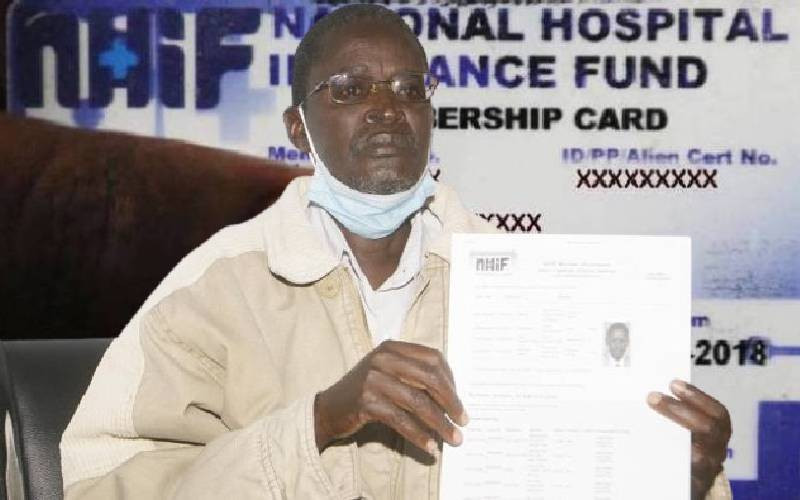

Crisis looms in health care following uncertainty over contributions to the national health scheme.It has emerged that Kenyans are shying away from making contributions to the National Health Insurance Fund (NHIF) as they wait for takeover of the scheme by the Social Health Authority (SHA), while others are remitting less than the current Sh500.

Sources says NHIF is now unable to meet its obligations, with hospitals demanding their dues.

A source at the Ministry of Health said the pronouncement on monthly remittance of 2.75 per cent has reduced collections.Operations at the two entities is now hanging in the balance after the courts halted the implementation of the new law.

Facts First

Unlock bold, fearless reporting, exclusive stories, investigations, and in-depth analysis with The Standard INSiDER subscription.

Already have an account? Login

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print

operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a

leading multi-media house in Kenya with a key influence in matters of national

and international interest.

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print

operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a

leading multi-media house in Kenya with a key influence in matters of national

and international interest.