A moratorium on the issuance of new licences to mining firms may have stagnated the sector, with potential investors moving elsewhere.

Existing players have had to do with licence renewals, but they too cannot increase the scope of their operations beyond areas covered by their licences.

The moratorium on the issuance of new mining and exploration licences has been in place since November 2019.

The government froze the issuance of new licences as it sought to clean up the industry as well as map out the country's mineral resources.

The move, the Mining Ministry has insisted, was done on the advice of the National Security Council (NSC).

Nearly four years on, there have not been any new activities. Analysts note that without new work on prospecting and exploration of minerals during the period, Kenya should not expect a new mining project in the coming years, with such projects taking years between making a find during the prospecting and exploration phases and commercial production.

"The moratorium has had quite a significant impact on investment in the mining sector in Kenya. Investments in the sector have somewhat stagnated and to some extent dampened international and local investors' appetite for investing in the mining sector in Kenya," said Rainbow Field head of Mergers and Acquisitions at Bowmans Kenya, a law firm.

"Unfortunately at this point, Kenya is not as attractive as an investment destination for the global mining industry because of this moratorium. There is just no entry opportunity currently. But if it is lifted, we have a good structure in place, the government is keen to support the sector... there are opportunities, and we will move up the ladder."

Different government officials have hinted at the possibility of lifting the moratorium.

Among them is the Mining, Blue Economy and Maritime Affairs Cabinet Secretary Salim Mvurya, who recently told Parliament that the government has put in place the necessary safeguards to sustain the gains already realised.

"The ministry is positive the reforms it is currently undertaking will catapult Kenya into a desirable mining investment landscape and attract the best in mining," the CS told the Senate when responding to questions raised by senators on the sector.

He explained that the moratorium was necessary to institute reforms geared at catapulting Kenya into a desirable mining investment destination and attracting the best mining companies.

Among the areas of focus during the moratorium, he said, is the conclusion of the National Airborne Geophysical and the generation of a preliminary report identifying over 970 mineral occurrences across the country.

Other reform areas included initiating the process of ground-truthing in prioritised 16 counties with critical and strategic minerals and the development of an in-house, in-country mineral licensing system.

Under the system, Mr Mvurya said, there will be an online mining cadastral integrated with national institutions like Kenya Revenue Authority (KRA), e-Citizen and Business Registration Services.

"The rationale was to safeguard Kenya's interests by developing the right data and eliminate speculation on the availability of substantial deposits," he told the Senate.

Moratorium

He added that the moratorium was also meant to allow the government to complete the mapping of mineral resource exercise without an influx of speculative mining licence applications that would have posed a threat to the mining sector.

"We have instituted a comprehensive audit of all mineral rights and weeded out all illegal licences, inactive, expired, idle and speculative hoarding to free up areas for serious investment and concessions," the CS told the Parliament.

It is not the first major policy decision that has hit the local mining industry. In 2015, the then-mining CS Najib Balala revoked 65 mining licences.

Despite the government not issuing licences for four years, several firms have shown interest in investing in the country's mining sector, which can still be described as fledgling.

This is considering that there have been mining operations spanning decades such as soda ash, but the sector still contributes negligibly to the economy.

"Even though the moratorium has been in place, we have seen quite an interest from both local and international investors to pursue some opportunities in the Kenyan sector," said Njoroge Kangethe, an associate at Bowmans Kenya, noting that a number of firms from Canada, Australia and China have shown interest in large-scale mining projects

"We also have interest from clients who are looking at getting into the mining space through the many transactions. Existing licensed companies have also been looking to transfer some rights or licences to investors who are willing to come to Kenya. Inasmuch as the moratorium has affected the mining space in Kenya, we still have some traction."

The mining industry has for years been said to hold huge potential, but it appears unable to realise this potential.

Consultancy firm

A 2015 report that consultancy firm Mckinsey did for the Kenyan government indicated that the full potential of mining could be in the region of $2.5 billion (Sh350 billion) in terms of direct revenues annually.

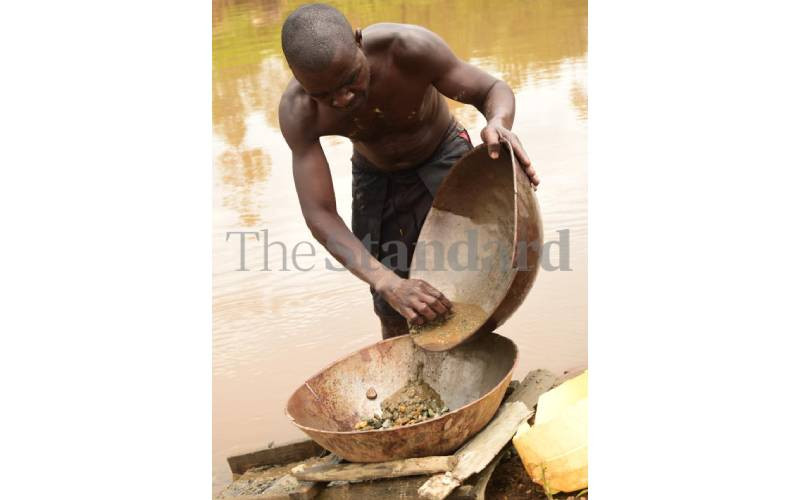

Among the proven key minerals are titanium, gemstones, niobium and gold.

Niobium, a rare earth mineral, remains among those that could bring about value for the country but remains unexplored.

Going by the reports published following initial surveys, Mrima Hill could have niobium with an estimated value of up to Sh5 trillion and may be one of the largest in the world outside of China and Brazil.

The mineral is used in strengthening steel alloys and could be a strategic resource for the country.

The government is also readying to start production of tin, tungsten and tantalum, used in industrial applications and many consumer products.

Despite what appears to be massive potential, the success story is limited and largely centred on Base Titatium's operations in Kwale County.

"While the Mining Act made a lot of progress in being such a modern piece of legislation, we were expecting it to transform the sector but there are still concerns with that legislation in terms of government pre-emption rights and the issue of strategic minerals," said Bowmans Kenya's Ms Field on what could be holding back the sector.

"So coupled with the moratorium, it has completely stagnated the sector. Once the moratorium has been lifted there may be a few other concerns from the sector about some segments of the Mining Act, but the first step is to lift the moratorium."

She added that other things that needed to happen for the sector to pick up significantly include offering tax incentives as well as making it easier for investors to set up in Kenya.

The industry contributes less than one per cent to the country's Gross Domestic Product.

This is, however, largely on account of exporting titanium ore minerals.

The value of minerals from Base Titanium's operation in Kwale stood at Sh28 billion in 2022, according to data by the Kenya National Bureau of Statistics (KNBS), which was 80 per cent of the value of minerals produced by the country at Sh35 billion.

The Standard Group Plc is a multi-media organization with investments in media platforms spanning newspaper print

operations, television, radio broadcasting, digital and online services. The Standard Group is recognized as a

leading multi-media house in Kenya with a key influence in matters of national and international interest.

The Standard Group Plc is a multi-media organization with investments in media platforms spanning newspaper print

operations, television, radio broadcasting, digital and online services. The Standard Group is recognized as a

leading multi-media house in Kenya with a key influence in matters of national and international interest.