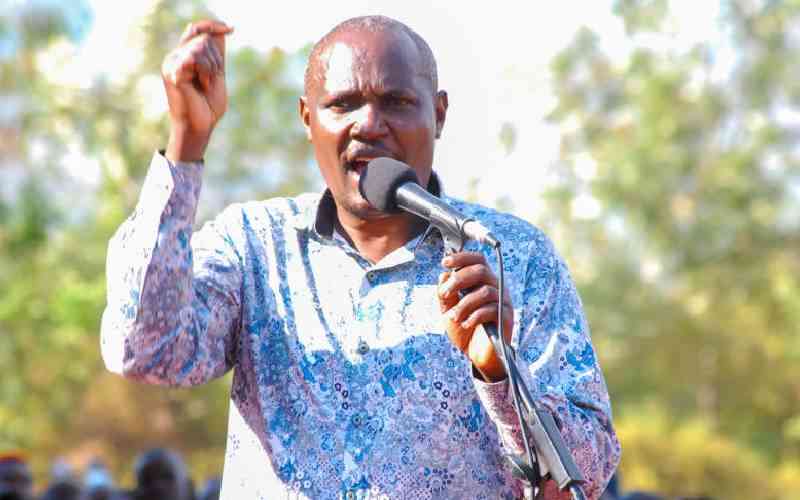

The National Treasury and Economic Planning Cabinet Secretary John Mbadi has laid bare the challenges facing revenue collection, saying that some of the taxman’s systems are not working optimally.

The CS, who was speaking during the ongoing Kenya Revenue Authority (KRA) Summit 2024 in Nairobi, Monday, cited iTax and the iCMS (Integrated Customs Management System), as some of the systems that are either outdated or not working as they should.

While KRA’s revenue collection has been increasing progressively in the last five years, hitting Sh2.4 trillion in the 2023/24 financial year, out of the target of Sh2.5 trillion, Mbadi said that there is more potential in the economy citing VAT as one of the areas.

He blamed the systems for failure by the taxman to collect revenue commensurate to the size of Kenya’s economy.

The iTax is a KRA system that is meant to improve efficiency by allowing taxpayers to register for Personal Identification Numbers (PIN) and file their returns as well. The iCMS system deals with customs duty, a key platform for importers.

Particularly, the CS pointed out the iCMS system saying it is not transparent. He said some of this information about the challenges was obtained directly from KRA staff.“Our system, iCMS is not working. That is the truth. We must have a system that is working. The iTax is outdated. This is the feedback I am getting (from KRA staff). They are saying it is outdated. And we have many more,” he said.

He identified one area that the iCMS system fails saying the amount of cargo getting into the country is not commensurate to the size of the economy.

“How come cargo going to the Democratic Republic of Congo is more than Kenya? How can South Sudan consume more than Kenya, and we are the biggest economy in the region? It is not true. Our systems are not working. We must fix them,” said Mbadi.

The CS noted that all other metrics, like the inflation rate that is now at 3.6 per cent and the stable shilling indicate that the economy is looking up.

This is apart from the interest rate which he noted is likely to go down due to the inflation rate and the Federal Reserve in the US also softening theirs and the public debt that has become a challenge to sustain.

“Our economy is very robust. The question we should be asking is how come we have challenges in an economy that is growing at more than five per cent which is above the average in the region and globally?” He posed. “Where is the problem? The problem is we have not collected the tax that we should.”

He announced that a new system is being put in place that will ensure every Kenyan pays their fair share of tax, listing PAYE from professional individuals who do consultancy like doctors, lawyers, accountants, and landlords among those targeted.

This will be complemented by the National Treasury’s medium-term revenue strategy that seeks to reduce corporate tax from 30 per cent to 25 as a way of rationalising tax expenditures and applying a Value Added Tax (VAT) at 14 per cent instead of 16 which will spur up economic activities like employment to expand the tax bracket.

“We have reached a stage to go a notch higher, become more facilitative, and move away from obstructionist so that we can benefit from technology and develop trade. It is embarrassing that the level of trade within African countries is minuscule compared to what we do with the rest of the world,” said Prime Cabinet Secretary and Cabinet Secretary Foreign and Diaspora Affairs Musalia Mudavadi, who explored how technology can be used to create better tax systems to facilitate trade.

KRA Commissioner General Humphrey Wattanga said the summit is a crucial platform for the authority to navigate the complexities of the economic landscape.

Mr Wattanga revealed that Kenya relies on regional and international trade taxes to finance the economy and assured that they are committed to trade liberation as a member of the World Trade Organisation, the Common Market for Eastern and Southern Africa and the East African Community.

“Technology is crucial for resource mobilisation and streamlining processes. KRA recognises technology's transformative power in taxpayer services as demonstrated in our policy reforms and modernisation efforts,” he said.

“Artificial Intelligence and machine learning will be pivotal in resource mobilisation, optimise resource allocation and predict revenue streams.”

The Standard Group Plc is a multi-media organization with investments in media platforms spanning newspaper print

operations, television, radio broadcasting, digital and online services. The Standard Group is recognized as a

leading multi-media house in Kenya with a key influence in matters of national and international interest.

The Standard Group Plc is a multi-media organization with investments in media platforms spanning newspaper print

operations, television, radio broadcasting, digital and online services. The Standard Group is recognized as a

leading multi-media house in Kenya with a key influence in matters of national and international interest.