Digital microlender Tala has provided Sh300 billion in credit to 3.5 million customers in Kenya over the past decade, underscoring the competitive threat posed to commercial banks by the mobile lending model.

The Nairobi-based firm, which also operates in Mexico, the Philippines and India, said on Friday it will use a fresh capital injection to expand access to cheaper loans and launch new products.

It aims to diversify into new markets through acquisitions of financial technology startups in Kenya and across East Africa.

Tala global chief business officer Jori Pearsall said the lender targets underserved segments historically excluded from traditional finance.

“Located primarily in emerging markets, they earn money in both the formal and informal economies but often don’t have access to savings, credit, bill payment tools or the ability to affordably transfer money,” Pearsall said in a statement.

“With our in-depth understanding of the mass market customer, and our data science capabilities, we are increasing our focus on partnerships and being an ecosystem enabler.”

Expand access

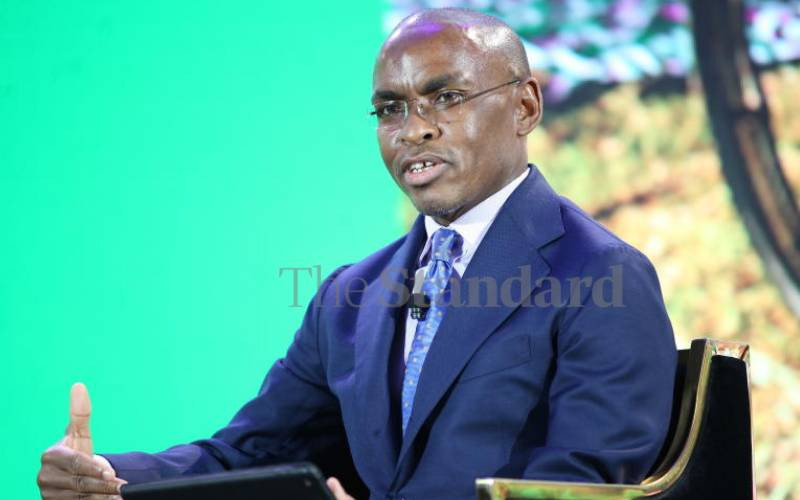

Tala Kenya general manager Annstella Mumbi said the fintech plans to partner with other financial institutions to expand access to credit for Kenyans.

“Looking into the future, Tala’s focus for the next decade will be three-pronged, that is, more customer-centric innovation coupled with ecosystem partnerships, expansion into other East African markets and the rest of the continent and policy or regulation to drive financial inclusion further,” she said.

Kenyan banks have in recent years tapped global debt markets like the International Finance Corporation, European Investment Bank, Agence Française de Développement and African Development Bank to secure capital for on-lending to businesses lured by lower rates and longer tenors.

But mobile lenders such as Tala have upended the domestic credit sector, responding rapidly to demand for digital loans via mobile phones.

The Standard Group Plc is a multi-media organization with investments in media platforms spanning newspaper print

operations, television, radio broadcasting, digital and online services. The Standard Group is recognized as a

leading multi-media house in Kenya with a key influence in matters of national and international interest.

The Standard Group Plc is a multi-media organization with investments in media platforms spanning newspaper print

operations, television, radio broadcasting, digital and online services. The Standard Group is recognized as a

leading multi-media house in Kenya with a key influence in matters of national and international interest.