The Governor of the Bank of South Sudan Dr James Alic Garang poses for a photo after receiving a certificate of commendation by the African Leadership Organization. [Courtesy]

East African Community partner states are in the process of harmonising critical policies and putting in place the requisite institutions to attain a single currency as outlined in the EAC Monetary Union Protocol.

The EAC common market - consists of eight countries including Somalia, the new member state.

Others are Burundi, Democratic Republic of Congo, Kenya, Rwanda, South Sudan, Tanzania and Uganda. It was set up in 2010 and currently comprises almost 300 million people.

Although the EAC has over the decades made progress in economic integration, like many other trade blocs it has struggled to overcome.

- American research firm banks on Nairobi office for regional growth

- Nancy Waweru: Cold urticaria robbed me of my sleep

Keep Reading

The EAC Monetary Union Protocol, which was signed on November 30, 2013, aims to converge the currencies of the partner states into a single currency.

The convergence of the currencies of all seven EAC partner states into a single currency was to take 10 years, which means the regional bloc was to have a common currency by 2024.

In the run-up to achieving a single currency, the member countries have to harmonise their monetary and fiscal policies, as well as their financial, payment, and settlement systems.

Also geared for harmonisation are financial accounting and reporting practices, policies, and standards for statistical information.

Full attainment of the single currency will see the establishment of the East African Central Bank, which will be preceded by the East African Monetary Institute (EAMI).

However, repeated delays in the implementation of the protocol have been impacting the expected goodies, like eased transactions at the borders.

Achieving the goal to set up the monetary union, experts say, would ease transactions, including payments among EAC citizens.

This, the experts add, would eliminate currency exchange challenges "as a single currency would be used across the region."

Discussions on this will be on the agenda of the 27th Common Meeting of the EAC Monetary Affairs Committee which will take place in Juba, South Sudan from today to Friday.

During the meeting South Sudan which is Africa’s youngest country will showcase its ongoing economic reconstruction.

The Governor of the Bank of South Sudan, Hon. Dr. James Alic Garang, who also doubles up as the current chair of the EAC monetary affairs committee has recently been recognized for his leadership and dedication to improving the nation's economy.

These accolades come from both the United States and Africa, highlighting the international impact of Dr. Garang's efforts.

Since assuming his position in October 2023, Dr. Garang has spearheaded a transformative modernization plan for the Bank of South Sudan. This plan focuses on: Enhanced Transparency.

He has boosted efforts to increase openness and accountability within the bank's operations to build public trust.

Improved Efficiency

He has also led to the Restructuring the Bank of South Sudan to better deliver on its mandate and exercise stronger oversight of the financial sector.

Staff Investment has also been up on his priority.

Implementing new staff benefits and policies to boost morale and improve overall performance are among his achievements.

These efforts are not going unnoticed by the international community.

News recently emerged of Dr Garang receiving recognition and congratulations from the United States South Carolina House of Representatives during a visit to the state.

Specific details about the nature of the recognition are pending, but it signifies the growing international recognition of Dr Garang's leadership.

Furthermore, Dr Garang was awarded a certificate of commendation by the African Leadership Organization. This prestigious continental body's recognition underscores the positive impact Dr Garang's endeavors are having across Africa.

These recognitions add to Dr Garang's growing list of achievements, including the "extraordinary effort" prize awarded by the US House of Representatives in Washington D.C. and the proposal within South Sudan to name a road after him.

Dr Garang's initial months in office have been marked by substantial progress. His unwavering focus on modernization, transparency, and staff well-being positions the Bank of South Sudan to play a more prominent role in guiding the nation's economic development. International observers will continue to follow Dr Garang's leadership with keen interest as it shapes South Sudan's economic trajectory.

Analysts see Dr Garang, a US-trained economist, as best suited to drive reforms in the country's banking sector given his wide-ranging experience in the academia and the financial sector as it emerges from the ruins of ethnic conflict.

Garang holds a PhD in Economics from the University of Massachusetts at Amherst, a Master of Arts in Economics from the same university and a Bachelor of Science in Economics (with Honors) from the University of Utah.

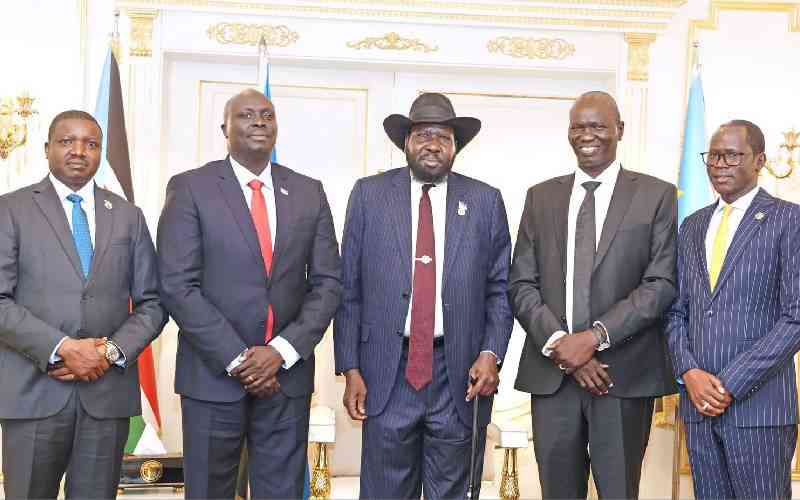

South Sudan Central Bank Governor Dr James Alic Garang, Minister of Finance and Planning Awou Daniel Chuang and President Salva Kiir after the swearing-in ceremony of Awou as the new head of Finance Ministry. [Courtesy]

He is a former lecturer at the Upper Nile University where he rose to become Deputy Dean, College of Economic and Social Studies.

He said he is determined to oversee President Salva Kiir's government's build a prosperous future for South Sudanese people who have endured years of strife both in the fight for independence and afterward.

As Africa's youngest nation, South Sudan gained independence from Sudan on July 9, 2011 amid high hopes of economic revival.

However, political disagreements soon erupted into a brutal conflict that displaced millions and ravaged the fragile economy

Now, a fragile peace is taking hold since rival factions signed a power-sharing agreement in 201

According to Garang, the country is embarking on a critical effort to reconstruct the economy, diversify the economy from non-oil revenue and provide opportunities for its long-suffering people.

Some early signs of recovery are emerging; Agriculture is bouncing back, infrastructure projects are connecting rural areas for the first time in years, and foreign capital is slowly flowing into sectors such as oil, mining and telecommunications.

The financial sector is also on the upswing and thriving. But challenges remain.

“The challenge for us is with the nature of our economy which is cash-based. The use of modern payment systems for example or instruments remains limited but we could say all is not lost. As a result, at the moment the bank is working on establishing a National Payment system with different components and payment solutions,” says Dr Garang.

“The other aspect where we remain behind the curve relative to sisterly central banks is the aspect of interoperability. But to overcome this challenge, we are building a national switch to help develop drive interoperability within the sector.”

Within the East African region, the advent of mobile money has revolutionised the lives of those who used to send and receive cash in envelopes via a costly and risky bus ride.

However, digital transactions are yet to transform customer-to-business (C2B) payments in South Sudan, which continue to be largely settled in cash.

This is because limited interoperability between different mobile money providers, especially across borders, and missing or outdated regulatory frameworks hinder the widespread adoption of digitised merchant payments, one of the prerequisites and key drivers of e-commerce and cross-border trade.

“In this context, the bank has been promoting the use of electronic payment systems, like mobile payments and payments through Internet banking and prepaid payment instruments such as debit cards, and credit cards. And speaking about mobile payments, like what you have in Kenya, for example, in the context of South Sudan, we have several mobile money operators,” says Garang.

The Standard Group Plc is a multi-media organization with investments in media platforms spanning newspaper print

operations, television, radio broadcasting, digital and online services. The Standard Group is recognized as a

leading multi-media house in Kenya with a key influence in matters of national and international interest.

The Standard Group Plc is a multi-media organization with investments in media platforms spanning newspaper print

operations, television, radio broadcasting, digital and online services. The Standard Group is recognized as a

leading multi-media house in Kenya with a key influence in matters of national and international interest.