Commercial banks maintained their position among Kenya's top tax generators, handing the taxman more than a third of all corporate taxes paid in the year to December 2022.

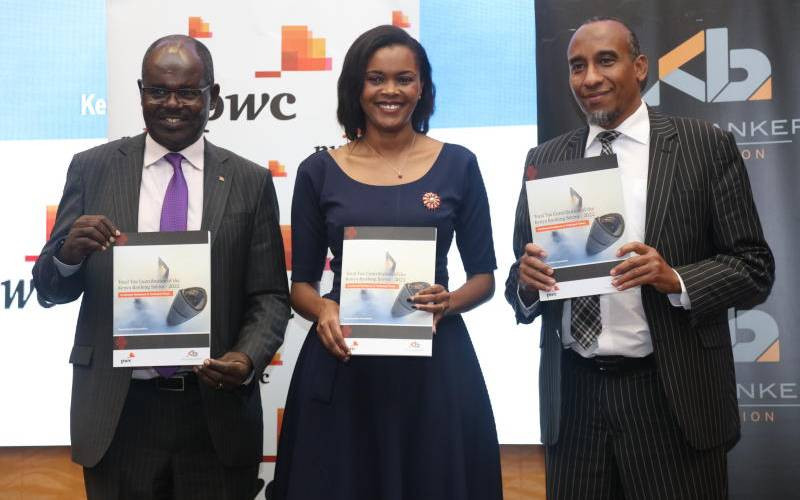

This is according to a new survey published by accountancy firm PricewaterhouseCoopers (PwC), backed by the Kenya Bankers Association (KBA).

The report released yesterday shows that corporate taxes paid to the Kenya Revenue Authority (KRA) jumped 77 per cent to Sh87.71 billion compared to a year earlier when the sector's taxes were Sh49.48 billion.

The contribution represented more than a third of the total corporate taxes received by KRA, cementing the lenders as a cash cow even as other sectors experienced a slowdown.

Local companies are required to pay 30 per cent of their profits as corporate taxes.

"The increase was due to a growth in balance of tax (a form of corporate tax) paid in 2022 and a growth in 2022 installment taxes (another form of corporate tax), both on account of year on year growth in profitability of the sector in 2021 and 2022," said PwC Tax and Transfer Pricing partner Alice Muriithi.

The study documented filings from 39 banks.

Overall, the banking industry contributed Sh181.27 billion in corporate, employment and other taxes accruing from day-to-day operations such as excise duty on transaction fees in the year under review.

"From a taxes collected perspective, the banking sector witnessed a significant rise in excise duty. Between 2021 and 2022, excise duty experienced a remarkable growth rate of 60.13 per cent," said the report.

"This can be attributed to an increase in non-funded income (including fees and commissions) and an increase in the volume and value of digital transactions given the continued investments in technology."

The growth in excise duty was also attributed to the introduction of excise duty on fees and commissions on loans with effect from July 1, 2021 meaning that excise duty was paid for the entire 2022 financial year - compared to only half of the 2021 financial year.

The Standard Group Plc is a multi-media organization with investments in media platforms spanning newspaper print

operations, television, radio broadcasting, digital and online services. The Standard Group is recognized as a

leading multi-media house in Kenya with a key influence in matters of national and international interest.

The Standard Group Plc is a multi-media organization with investments in media platforms spanning newspaper print

operations, television, radio broadcasting, digital and online services. The Standard Group is recognized as a

leading multi-media house in Kenya with a key influence in matters of national and international interest.