It now costs more to take your favourite beer at your local hangout than in neighbouring countries like Uganda and Tanzania.

This is as the weight of tax makes beers and other alcoholic beverages produced in Kenya expensive, retailing at nearly double the prices of similar products in Uganda and Tanzania.

Consequently, Kenyans living in border towns are crossing over to the neighbouring countries for their favourite drink.

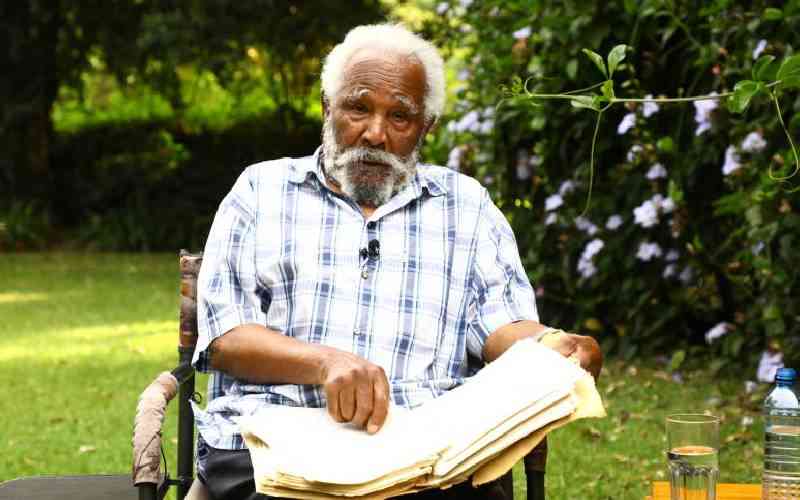

"The recommended retail selling price for a bottle of Tusker, for example, is Sh190. A similar product in Uganda and Tanzania is selling at an equivalent of Sh100," Eric Kiniti East African Breweries Group corporate relations director said in a recent interview with Standard Group's Spice FM.

"You go to most of our border towns and find that people would rather cross over to the other side of the border and drink beer than walk back. Out of this Sh190, about Sh107 is actually tax - excise, VAT and what we pay as corporation tax," said Kiniti, adding that even as the government takes the lion's share, the brewer has to share the balance with multiple players along the value chain including its distributors, farmers, suppliers and shareholders.

The tax-linked price rises are being witnessed in all sectors of the economy as the Kenya Kwanza administration seeks to double tax revenues during its first term in office.

The result, experts say, is that the government is losing on tax revenues not just in the case of beer or borders but across the country while pushing its people to a life of constantly chasing bargains.

The quest to double tax revenues over the next few years might mean a further squeeze on the current pool of taxpayers as the Kenya Revenue Authority (KRA) races to meet the targets. This is already evident, with the recent hikes in some taxes that have resulted in an uproar among businesses and consumers.

And while the government has been quick to hike taxes and demand prompt payments from Kenyans, it has been slow to pay local businesses such as contractors and suppliers that provide it with different goods and services.

The national government, state corporations and county governments owed different contractors, suppliers and other entities they have dealings with upwards of Sh600 billion as of September 2022.

The pending bills, which persisted throughout the Jubilee government's second term, have been a major cause of concern for the private sector. The Kenya Kwanza administration appears to be in no rush to settle these debts going by happenings over the five or so months it has been in power.

In the quarter to September 30, for instance, the national government's Ministries, Departments and Agencies (MDAs) paid just 1.94 per cent of their total pending bills, according to the latest report by the Controller of Budget (COB).

The Kenya Kwanza administration has recently set the bar high for KRA and set an ambitious tax collection target of Sh3 trillion by June 2024. Tax revenues are expected to further double within the administration's first term in office.

KRA is expected to collect Sh2.19 trillion in the current financial year.

"As part of the economic turnaround plan, the government will scale up revenue collection efforts by KRA to Sh3 trillion in the financial year 2023/24 and Sh4 trillion over the medium term. In order to achieve this, the Government will undertake a combination of both tax administrative and tax policy reforms," said Treasury in the draft Budget Policy Statement published in January.

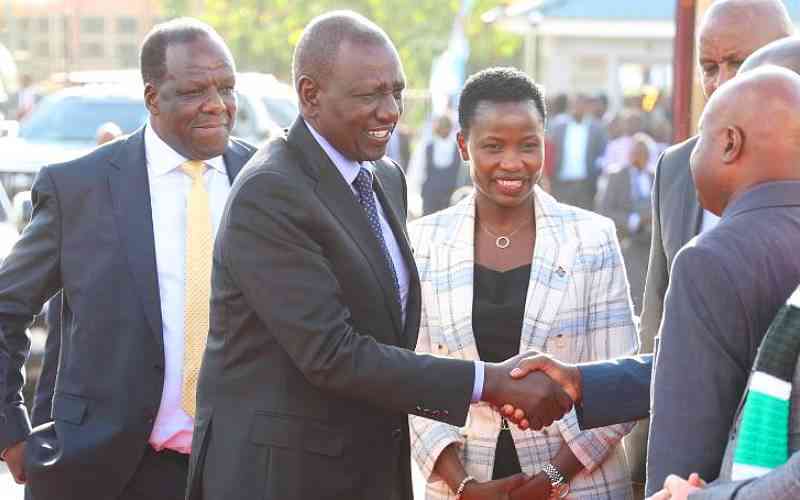

During last year's Taxpayers Day which is organised by KRA annually, President Ruto set a target to double tax collections by the end of his first term in office.

At the time, the president noted that it is possible to increase tax revenues by 100 per cent over the next five years as tax collections remain far below their potential. He noted that technology could play a critical role in growing tax revenues.

"The imperative of embracing technological solutions to KRA's strategic issues is clear. There are only seven million people with KRA pin numbers. At the same time, in the same economy, Safaricom's M-Pesa has 30 million registered customers, transacting billions daily," said Ruto.

"The fact that this opportunity remains unclear to KRA demonstrates why radical changes are necessary. Every Kenyan with an ID should have a PIN number. Technology and a considerate, fair and professional mobilisation will do the job quite well. Safaricom, a telco, has registered more people than KRA, a powerful state organisation. It is very clear that the magic lies in technology and strategy, not power and resources."

Experts say raising taxes might not have the intended impact of increasing tax revenues and that instead, the government should instead grow the tax base.

In some instances, tax experts say, the government should consider reducing taxes to boost businesses as well as the spending power of Kenyans, a move they say can help the economy that is reeling from multiple shocks including the prolonged dry spell, high energy costs, the Covid-19 aftershocks that have had the impact of increasing the cost of living.

"Kenya has some of the highest tax rates in the world. Our income tax brackets have pretty much stayed the same since early 2000. The highest tax rate of 30 per cent is applicable to all income above $250 per month at the current exchange rate. When the tendency is to tax every possible aspect of life, there is hardly any disposable income left for people to spur demand and create growth," Kunal Ajmera, the chief operating officer at Grant Thornton, a consultancy firm.

"While no revision has taken place in our tax brackets, the countries world over are lowering the tax rates and enabling people to save and spend more. In a recent budget announced in India, all personal income up to 700,000 Indan Rupees, that is approximately Sh1.1 million per annum was tax exempted."

"Reducing marginal tax rates to spur economic growth is a commonly used policy with the notion that lower tax rates will give people more after-tax income that could be used to buy more goods and services."

Additionally, Ajmera said, reduced tax rates may boost savings and investment, leading to further production and reduced unemployment as it leads to higher disposable income, allowing the consumer to spend more, and increase the Gross National Product (GNP)

"While we have a considerable debt burden which necessitates government to raise adequate revenue for repayment, the increasing tax burden is not an optimal solution. Focus has to be on incentivising investment, creating demand and spurring growth. The tax base has to be widened," he said in an interview.

"A recent judgement favouring the tax authority to charge VAT on the export of services is another example of how we are making Kenya a non-competitive country. This makes our services more expensive compared to our peers. For many companies, this tax rule makes it downright impossible to operate in Kenya and leads to closures and loss of employment opportunities."

"Even if the VAT and income tax rates cannot be reduced due to our debt burden the policymakers should focus on providing investment. With the cost of capital so high, and no tax breaks in sight, there is hardly any incentive for businesses to invest."

Nikhil Hira, a tax expert and business partner at Kody Africa LLP noted lowering certain taxes could help boost tax collections as businesses and traders move higher volumes on account of lower market prices.

He added that the government should also focus on bringing into the tax bracket the jua kali sector which has always been cited as key in growing the number of taxpayers but the option has never been seriously looked into.

"I don't think more tax is a solution. I believe reducing rates, at least a little, may be the better way to go. Often this does result in more tax. The issue is the jua kali sector. It accounts for a lot of our workforce and maybe many don't have to pay tax," he told the Standard.

"Those that do are not being pursued. One solution could be to allow them to do business in a specific place with a modest fee. Maybe not raise much but it is a start. This happened in Kenya in the early nineties."

The Kenya Association of Manufacturers (KAM) noted high taxation will not spur investment and demand, especially in the prevailing tough economic times when affordability and share of wallet on essentials is become stretched. When businesses shut down or downsize there is a risk of job losses.

"Last year's inflation adjustment on excise taxes and the current proposal for an increase by three to fourfold in excise stamp tax will dampen demand and further curtail corporate earnings which shall have a ripple effect on all other taxes including corporate tax, pay as you earn (PAYE) and value-added tax (VAT)," said KAM chairman Rajan Shah.

High taxes have also made Kenyan products expensive and this is demonstrated by local alcoholic beverages.

The push to increase taxes as the government looks to raise more than Sh3 trillion in the next financial are despite the fact that the government has been slow to pay local businesses for services they have offered to different state agencies.

The different agencies within the national government as well as parastatals and county governments have pending bills as high as Sh603 billion as of September 2022, according to reports by the Auditor General.

The biggest pile of pending bills is owed by state corporations at Sh359.9 billion

The national and county governments owed businesses Sh243.71 billion as of September 30, according to the latest report by the Controller of Budget.

Counties owe the largest share at Sh161.36 billion while Ministries, Departments and Agencies (MDAs) owe Sh82.35 billion.

MDAs paid a paltry Sh1.63 billion or just 1.94 per cent of total pending bills of Sh82.35, according to the report by COB.

The Controller of Budget, citing data from the National Treasury noted that for the period ending September 2022, pending bills for State Corporations were Sh356.9 billion.

Other than suppliers of goods and services, the parastatals have also not been remitting deductions to such entities as the National Hospital Insurance Fund and the National Social Security Fund (NSSF).

"The State Corporations' pending bills include payment to contractors or projects, suppliers, unremitted statutory and other deductions, pensions arrears for Local Authorities, Pension trusts, and others," said the COB in its report for the period ending September.

"The highest percentage of the state corporation's pending bills (67.6 per cent) belong to contractors or projects and suppliers. The Controller of Budget recommends that Accounting Officers ensure payment of the eligible pending bills is honoured and prioritised in the remaining period of the financial year 2022/23."

Counties owed suppliers Sh161.36 billion as of September, with Nairobi County being the largest defaulter, accounting for Sh6 out of every Sh10 of the pending bills by counties. Other counties, the COB noted, were not making efforts to settle their pending bills.

"As of September 30, 2022, Counties reported accumulated pending bills amounting to Sh161.36 billion. They comprised Kshs.33.98 billion for development expenditure and Kshs.127.38 billion for recurrent expenditure. The Nairobi City County accounted for 62.2 per cent of pending bills at Kshs.100.36 billion. Other counties with high pending bills are Wajir at Sh5.50 billion, Mombasa at Sh4.51 billion and Kiambu at Sh4.81 billion. The Mandera County Executive did not report any pending bills," said the COB report.

"The Controller of Budget advises county governments to settle all eligible pending bills as a first charge in the financial year 2022/23. Further, the National Treasury is urged to ensure that the disbursement of the equitable share of revenue."

The Standard Group Plc is a multi-media organization with investments in media platforms spanning newspaper print

operations, television, radio broadcasting, digital and online services. The Standard Group is recognized as a

leading multi-media house in Kenya with a key influence in matters of national and international interest.

The Standard Group Plc is a multi-media organization with investments in media platforms spanning newspaper print

operations, television, radio broadcasting, digital and online services. The Standard Group is recognized as a

leading multi-media house in Kenya with a key influence in matters of national and international interest.