Unlike presently when crime has gone hi-tech, some 50 years back, scenes of armed criminals engaging in shootouts and standoffs with the police defined gangland.

Today, a criminal can steal millions without using coercion or violence - a departure from what used to happen in the 1970s through the 1980s into the 1990s and up to the millennium.

Crime has evolved. Most criminals do not necessarily require guns, machetes, knives or crude weapons to commit robberies.

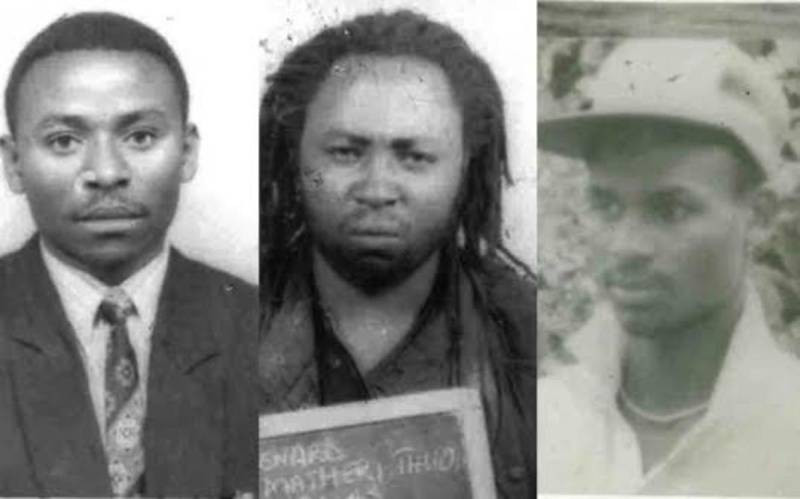

If Peter Mwea alias Wakinyonga, Benard Matheri aka Rasta, Anthony Ngugi Kanagi aka Wacucu, Gerald Wambugu Munyera alias Wanugu, Edward Shimoli aka Carlos the Jackal and Simon Matheri Ikere were alive, they would probably be ashamed of themselves for the trouble of having to risk their lives in search of money.

Their stories are still etched in the minds of many Kenyans. The six gangsters were daring. And the gun was their reliable tool of trade.

Although rookies trying to curve a niche in the underworld use guns, were he still around, Wakinyonga, regarded as the 'Godfather' of future hardcore criminals, would be perplexed that a laptop or mobile phone can be a weapon for raiding banks.

During their heydays, the capital city witnessed frequent violent robberies and bank heists leaving everyone including police officers worried.

But now, gun crime is gradually being replaced by white-collar and organised crimes.

Such is the evolving nature of crime that fraudsters rob or con victims with such ease that by the time the crime is discovered, the swindlers are miles away plotting their next mission.

Evolved criminal

"The present-day criminal is a complete contrast of the 90s, and there are several factors explaining the metamorphosis," says Dr John Omboto, a lecturer at Kenyatta University.

According to Omboto, with advanced education and knowledge, criminals are exploiting technology to commit crimes, which police lack the capacity to crack.

"We have highly intelligent graduates who remain unemployed; and with computer knowledge and IT skills, they are easily predisposed to crime. This is why cases of cybercrime, which don't require much effort, are on the increase," states the lecturer who specialises in Criminology, Penology and Rehabilitation of Offenders.

A member of the Professional Criminologists Association of Kenya (PCAK), Dr Omboto says there is need to retool law enforcers so that they can be at par or way ahead of the fraudsters.

That a senior police officer was recently conned of millions of shillings is confirmation of how criminals seem to be a step ahead in fake money doubling schemes, dubious gold schemes, bank card fraud, identity theft and advance fee scams.

Administration Police officer Abdirahaman Ali Dima lost Sh24.4 million to a sweet-talking criminal who convinced the Commissioner of Police that he would make extra millions by re-selling a rupee, stove, beacon and an iron box sold to him by Ray Ochieng Otieno, the fraudster.

Ochieng was also accused of swindling the officer's friend Ibrahim Isaack Musa of Sh7.1 million under similar circumstances.

Ali and Isaack were fooled into believing they could make a profit of more than Sh128 million after re-selling the four items. Ochieng was charged before a Makadara court last month.

On April 19, two Kenyans and a Congolese national were arraigned in court for obtaining Sh65 million belonging to Sadegh Sadeghan, an Iranian national, who was conned in a fake gold scam.

The accused had promised to sell Sadegh 60 kilogrammes of gold. Cases of foreigners being conned in phony gold deals continue to be reported despite frequent warnings from the police.

A week earlier, Kenney Atinse, a Nigerian national, was presented in a Makadara court for obtaining Sh300,000 from Esther Wanjiku Kamau by pretending that he was in a position to triple the amount.

Wanjiku was introduced to Atinse who convinced her that the Nigerian wanted to introduce them to a lucrative business involving the multiplication of money. They struck a deal and Wanjiku surrendered the money, only to realise she had been conned and left stranded at their 'business premises' in Kasarani.

According to Central Bank of Kenya (CBK), fraudsters are continuously coming up with new tactics to swindle people for financial gain. As technology advances, so does the level of sophistication used to lure people into parting with their money or assets.

"It is therefore important to be alert and cautious about the information you receive or any solicitations geared towards getting you to share personal information or invest in certain schemes," warns CBK.

The criminals have also been sweeping personal accounts clean through bank card fraud, identity theft or advance fee scams. So many people across the country have lost their monies in incidents police are struggling to contain.

For instance, in bank card fraud, the criminals either send, text or email messages that appear to originate from a targeted victim's account. They entice the would-be victim to share confidential information like account number, mobile number, personal identification number (PIN) and password, among other details.

In seeking such details, which they use to steal money from the account, the fraudsters pretend that the bank account needs to be updated.

Alternatively, the scammers offer a gullible victim huge amounts of money or goods with the caveat that the 'beneficiary' must first part with a certain fee for processing the money or cargo. Once the fee is sent, the tricksters disappear. Several people have fallen victim to this fraud.

Identity theft

Identity theft involves criminals assuming a person's identity to steal. The thieves obtain an individual's personal information like name, identity card number or bank details, which they use to make financial transactions like transferring money from the account or taking a loan.

On May 8, Bonface Kipng'etich Kirui, 34, was charged in a Kilimani court with stealing about Sh700,000 from two MPs after swapping their mobile phone SIM cards.

He then transferred the money to himself and took loans from various mobile money lending apps.

A prosecutor told the court that Kirui swapped Safaricom SIM cards of Marakwet West MP Timothy Toroitich and his Matungulu counterpart Stephen Mule before emptying their accounts.

In count one, the accused was charged that on the night of April 12, at an unknown place, he stole Sh547,567 from KCB Bank belonging to Toroitich.

"On diverse dates between March 23 and 26, 2023 at unknown place and time within the republic of Kenya, Kirui jointly with others not before court stole Sh133,785 from M-Pesa account, Timiza account, M-Shwari account, Vooma App, KCB M-Pesa account and KCB Bank account of MP Mule," stated the second count.

And last December, detectives arrested David Mutai alias Hillary Langat Matindwet after linking him to a SIM swap syndicate with roots in Mulot, Bomet County.

Police said the man was the mastermind behind SIM swapping by the scammers who hijack victims' mobile numbers that they use to gain access to person details, which they use to steal money in mobile and bank accounts.

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print

operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a

leading multi-media house in Kenya with a key influence in matters of national and

international interest.

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print

operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a

leading multi-media house in Kenya with a key influence in matters of national and

international interest.