If the battle for inheritance following the death of many of Kenya’s filthy rich is anything to go by, then indeed, where there is a will - and billions at stake - there isn’t always a way.

We have been treated to dramas of soap opera proportions. We are talking about the cases of the late tycoon and former Starehe MP Gerishon Kirima and the late Olympic marathon champion, Samuel Wanjiru.

There is also the never-ending complicated inheritance court battle pitting three children of the late billionaire-politician and businessman Njenga Karume over the management of his sprawling empire valued at billions of shillings.

Karume’s beneficiaries include a wife, four sons, four daughters, grandchildren, a driver, bodyguard and cook.

You probably remember the wrangles that followed the death of Nakuru hotelier Stephen Kung’u of the famed Hotel Kunste among a string of other properties, besides the Sh1.5 billion held in a fixed deposit account. On this list too is the Nakuru family of the late trader Joram Kamau, who own Tuskys supermarkets. The list of blood not being thicker than money is seemingly.

In fact, we can slot in the two sons of the late city billionaire Abdul Karim Popat, who died four years ago. The two brothers - billionaires in their own right - are fighting over their father’s multi-billion shilling empire straddling five continents.

Abdul Karim Popat came into national limelight after he was kidnapped by Alois Kimani, James Wamae and Ken Kinyanjui who demanded Sh200 million ransom in 1998. Cops tracked the phone calls to the kidnappers’ Karen hideout, rescuing Popat after a 60-hour drama in which Alois was killed.

Azim Popat, who is the late Popat’s first-born child, has sued his younger brother, Adil Popat, accusing him of taking Sh500 million worth of shares in the family’s flagship business, Simba Corporation, where he is the Chief Executive Officer.

Azim is also casting doubt on the validity of a will that was allegedly written and lodged by his father at a city law firm.

Azim also alleges that Adil, the brains behind Nairobi’s Villa Rosa Kempinski hotel, has hidden from the family several prime pieces of land in Canada and Portugal. Azim further claims that Adil isn’t truthful about trusts and bank accounts in Gibraltar, British Virgin Islands, Dubai and Guernsey.

Although Azim is set to inherit Sh820 million from his late father’s estate, he is still bitter that his younger brother is inheriting the bulk of the estate estimated at Sh2.5 billion. Azim’s son, Jameel, is set to inherit Sh338 million. Adil, in his response to the suit, says his elder brother had a strained relationship with their late father and isn’t entitled to the wealth he’s seeking.

Why do billionaires’ children fight over wealth? Why can’t most emulate the example of the Kenyattas, the Odingas and the Ndegwas, whose family businesses thrive long after the death of the patriarch?

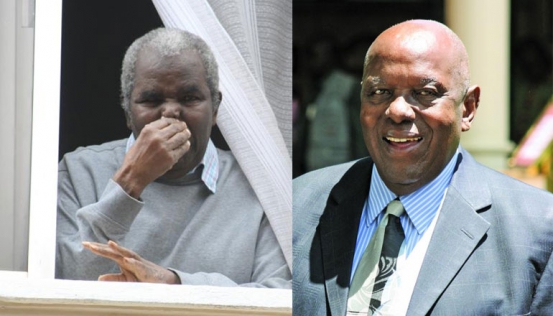

In an interview with Business Daily, former Attorney-General Charles Njonjo said he had sat down with his children and agreed on their inheritance.

“We have sat together and they know what they will get and inherit. There is a will they can’t challenge and I advise our people to write wills,” Njonjo is quoted as saying.

According to Frank Sabwa, a financial consultant, the biggest mistake many wealthy people make is never involving their children or their spouses in family businesses.

“They will work so hard, use their money to shield their children or spouses from hard work, and when they die, the children are left with a lot of wealth but zero management skills,” he says, adding that any businessperson should from an early age inculcate the value of hard work in their children.

“People should pass on family values, not values of consumption, but the value of building the business. For instance, you will find that many people who took over their parents’ businesses and made them more profitably joined the business straight from school, at a low level and worked their way up the ladder to head the company,” explains Sabwa.

He gives the example of the British royal family, whose offspring is taken through rigorous training, in socialising, mannerism, and even military training to prepare them for their future roles as kings or queens.

University of Nairobi sociologist Ken Ouko, however introduced an entirely divergent opinion in a previous interview. He apportioned blame on ‘upper-class socialisation,’ where children born with silver spoons in their mouths invariably suffer from chronic economic laziness spiced with a lofty presumptive attitude about access to the goodies of life without investing in any effort.

Ouko explained that children born in the upper echelons of society tend to suffer from ‘productive lethargy’ in that they remain stagnant in personal development, but seem outwardly well progressed.

“This is because they always appear in public well spruced up as if they are so ‘with it,’ yet inside, they are empty shells devoid of any individual initiative that could pave the way to individualistic economic independence,” argued Ouko.

The sociology scholar added that, “The degeneration of wealth often witnessed among the rich is as a result of failed parenting. The wealthy are often absentee parents whose offspring get the best in the hands of million-dollar nannies within carefully crafted environments that are almost socially-sanitised to such an extent that such children have no chance of witnessing how the other world lives.”

Ouko went on to charge that, “These children end up lacking in individualism and their survivalist instincts are acutely numbed by a rock-star lifestyle whose cost they have no idea about.” He noted that in most cases, these children are left in charge of money they had no hand in generating and hence, their preoccupation is only with squandering it at the expense of generating more.

“It is against this backdrop that such a parent will go overboard in ensuring their children lack nothing,” offered Ouko.

“Although with good intentions, the effect is usually that they end up raising lazy, spoilt and self-centred brats who think everything can be sorted out using their fathers’ money. These are the types who end up fighting over wealth they didn’t have a hand in creating,” he added.

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print

operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a

leading multi-media house in Kenya with a key influence in matters of national and

international interest.

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print

operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a

leading multi-media house in Kenya with a key influence in matters of national and

international interest.