×

The Standard e-Paper

Kenya’s Boldest Voice

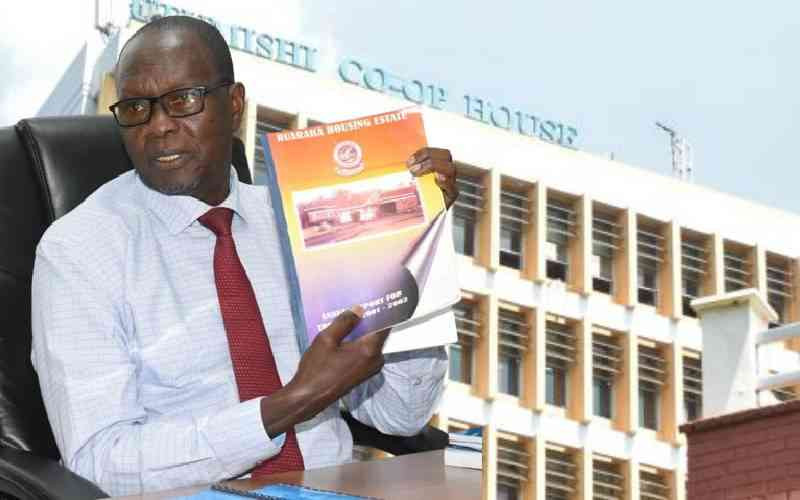

Ruaraka Housing Estate Limited has dismissed claims that the operations of the company are shrouded in secrecy.

The company's chairman Albert Waweru Miare said the investment is financially stable despite economic hardships resulting from inflation and the effects of Covid-19 pandemic.