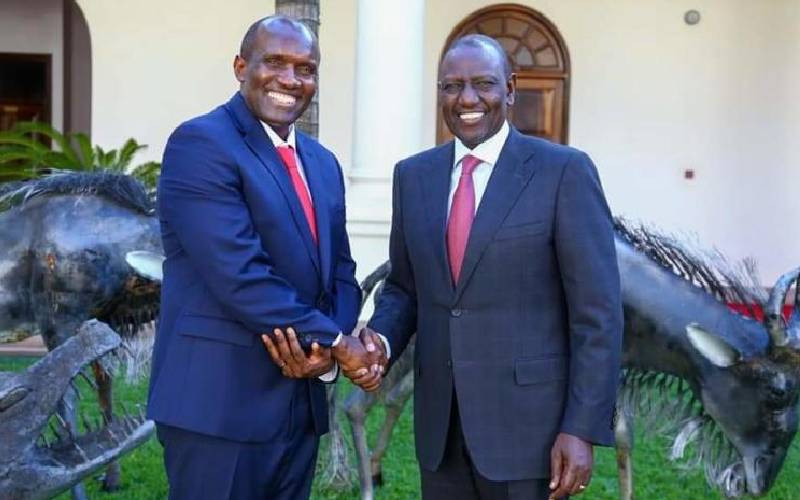

US-based Kenyan tycoon Julius Mwale with President William Ruto at State House on Thursday, March 8. [Photo, Courtesy Facebook]

×

The Standard e-Paper

Smart Minds Choose Us

Businessman Julius Mwale and founder of Mwale Medical and Technology City in Butere has been named among investors buying Forbes at Sh109 billion.

US publication Axios reported that US technology billionaire Austin Russell was a leader of the consortium that raised money for 82 per cent of Forbes ownership.