First things first; why should you as an individual, whether in business or employment, care about Kenya’s Gross Domestic Product (GDP)? Well, there are couple of reason why you should.

First things first; why should you as an individual, whether in business or employment, care about Kenya’s Gross Domestic Product (GDP)? Well, there are couple of reason why you should.

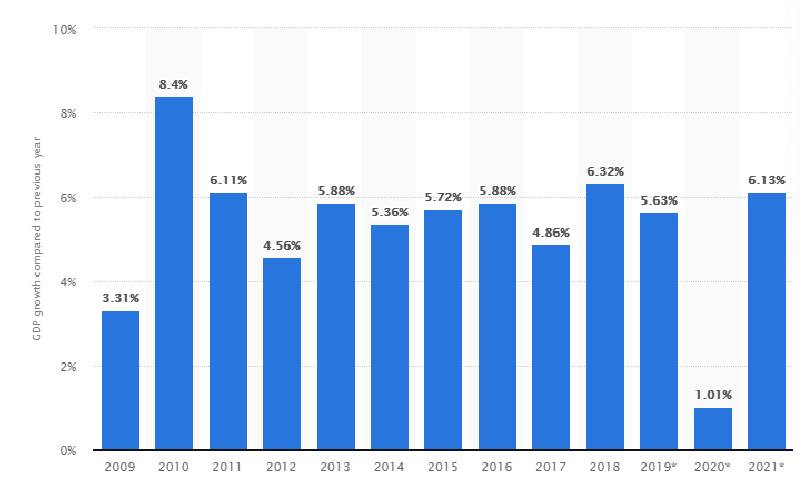

1. The direction of GDP movement is used as an indicator of the general health of an economy. When it goes up, the economy is doing well. Employment will increase with companies hiring more workers, giving people more money to spend. This then generates more business. When GDP is shrinking, businesses slow down production and expansion, and workers are laid off.