×

The Standard e-Paper

Stay Informed, Even Offline

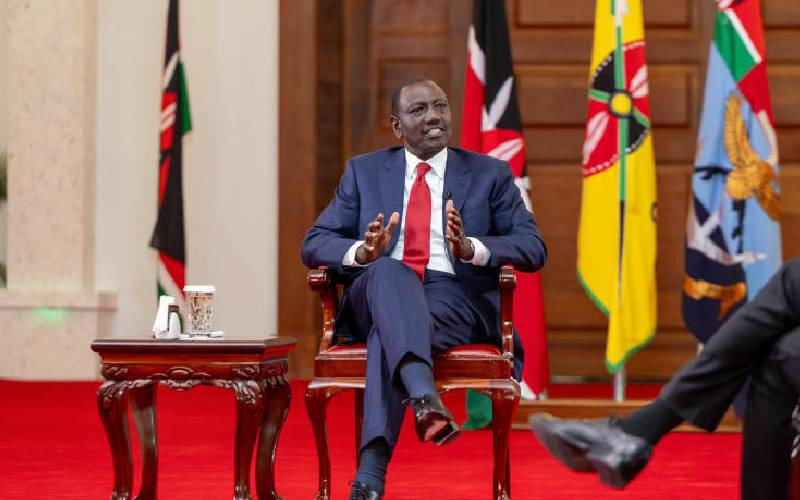

As the 2024 fiscal year begins, the Kenya Kwanza administration faces hard questions that are as economic as they are political.

A second week of anti-tax protests meant the 2024 Finance Bill was not signed into law, but this was really an accountability moment for Kenya's leaders.