×

The Standard e-Paper

Kenya's Bold Newspaper

Audio By Vocalize

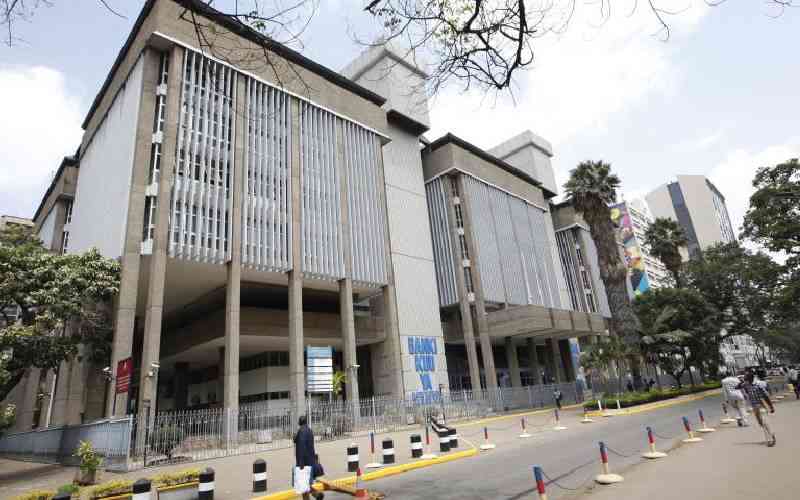

The Central Bank of Kenya (CBK) has informed Parliament that the government has already borrowed over three-quarters of its emergency funds at the apex bank in under six months, leaving only a quarter remaining.

The Sh97 billion emergency facility domiciled at the CBK is designed to alleviate the government's financial strain by balancing out the fluctuations between income from budgeted revenue and expenses, offering temporary relief.