×

The Standard e-Paper

Fearless, Trusted News

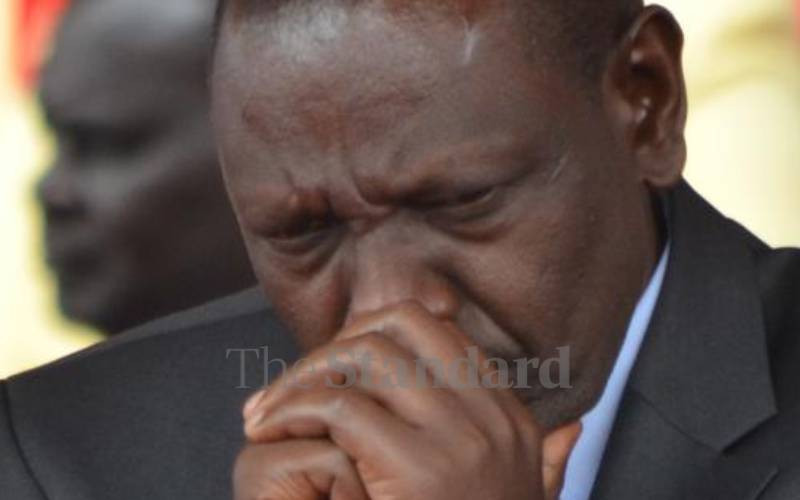

President William Ruto resumes official public duties after the Easter weekend as the country grapples with political and economic crises.

Safeguarding and moving forward towards tangible outcomes of the political truce he recently inked with opposition leader Raila Odinga will be key focus for President Ruto with a weight of national expectation on his shoulders, said governance experts.