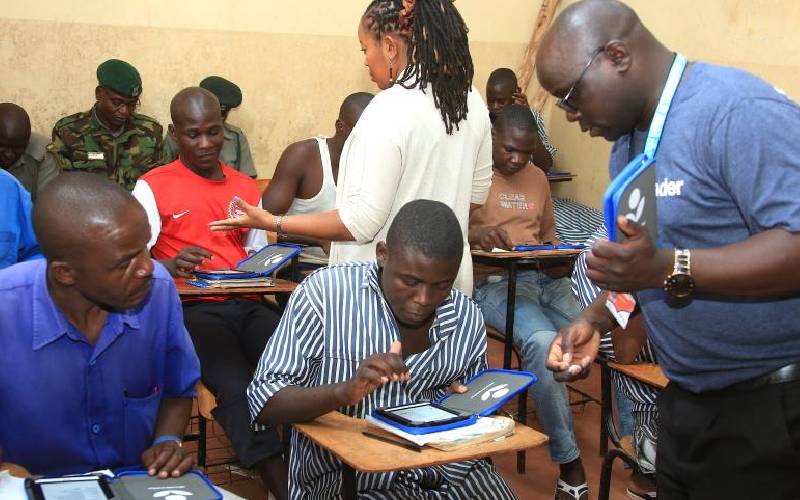

Kenya National Library Service Kakamega branch Senior Library Assistant Collins Sitima (right) train Kakamega prisoners and waders on how to operate World reader digital book devices which comply with Kenya education curriculum during the official launch of digital reading. [Benjamin Sakwa,Standard]

The informal sector also referred to as Small and Micro Enterprises (SMEs) or the “Jua Kali” sector that includes basic value addition, cottage industries, retail trade and vendors, food kiosks, second hand clothes, shoes, building materials, personal care products and much more, is the largest employer in Kenya. This sector accounted for 83 per cent of employment in 2020 according to the Kenya National Bureau of Statistics (KNBS).