×

The Standard e-Paper

Join Thousands Daily

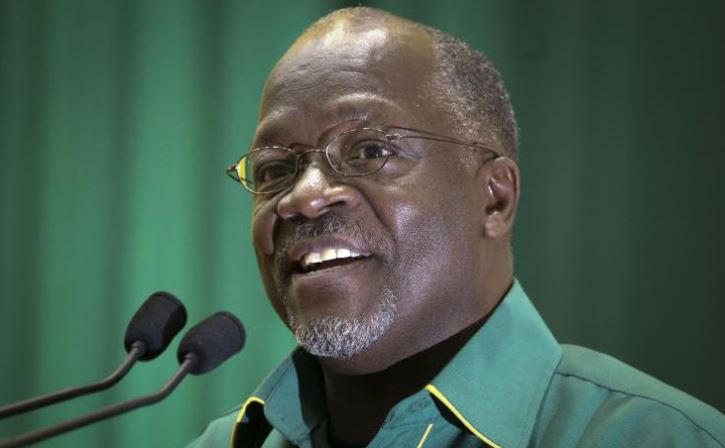

When Tanzanian President John Magufuli criss-crossed the country on the campaign trail ahead of Wednesday’s elections, he touted the billions of dollars his government has spent on a new hydropower dam, a railway and a revived national airline.

“Effective leadership must plan and prepare well,” he told a rally in northern Tanzania last week, reeling off figures on how government revenues had nearly doubled, helping fund the railway and dam.