×

The Standard e-Paper

Kenya’s Boldest Voice

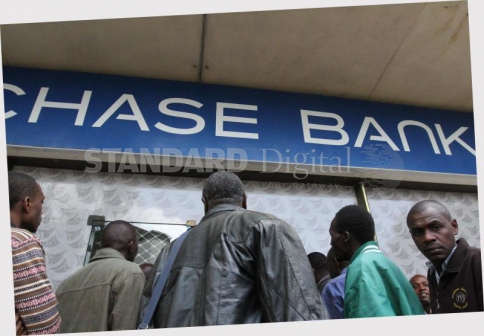

NAIROBI, KENYA: Calm and confidence has greeted the reopening of Chase Bank in State Bank of Mauritius colours following the country’s first carve out deal in banking.