×

The Standard e-Paper

Home To Bold Columnists

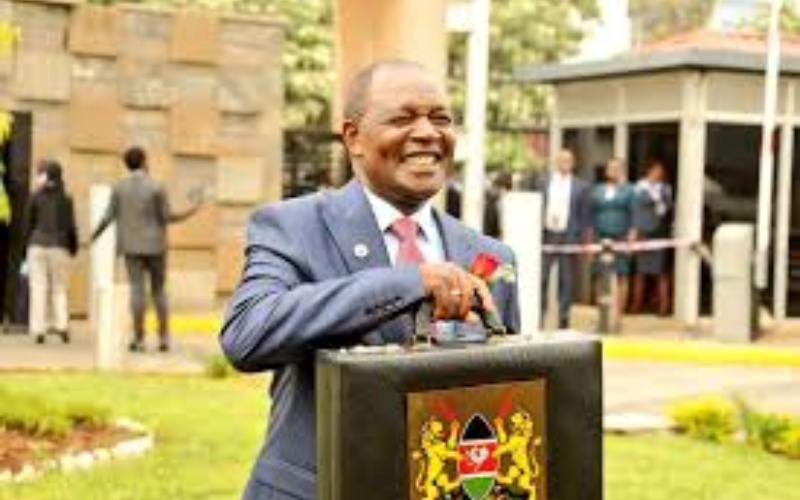

The National Treasury might have to slash Sh178 billion from the initial 2024/2025 Financial Year's budget proposal to accommodate changes made in the Bill, National Treasury Cabinet Secretary Prof Njuguna Ndungu discloses.

This comes a day after the government reversed several tax proposals in the Finance Bill 2024, following a Parliamentary Group meeting for the ruling coalition held at State House on Tuesday.