×

The Standard e-Paper

Stay Informed, Even Offline

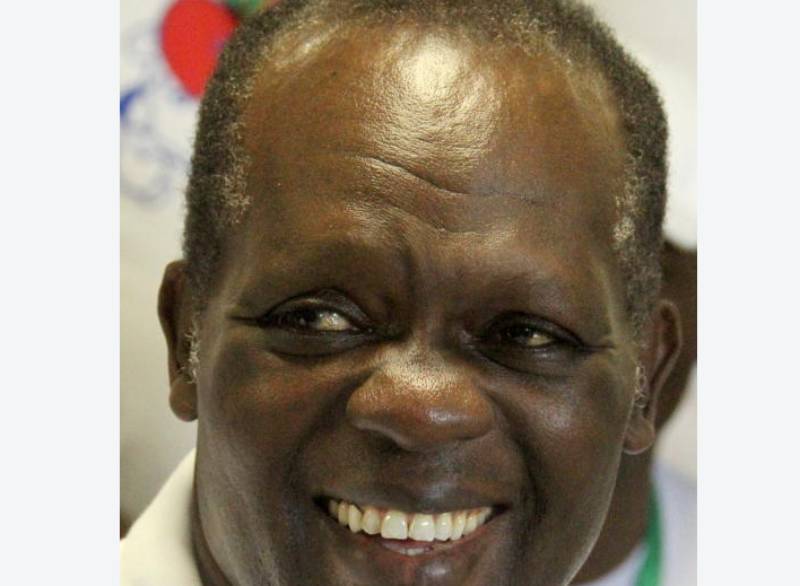

Jubilee Secretary General Raphael Tuju (pictured) yesterday got a relief after the Court of Appeal halted hearing of an insolvency case touching on his business that borrowed a Sh1.5 billion loan from East Africa Development Bank (EADB).