The Government is disbanding Mumias Sugar Company (MSC) board of directors and sending home more than 300 staff members in a Sh5 billion deal with lenders aimed at reviving the ailing company.

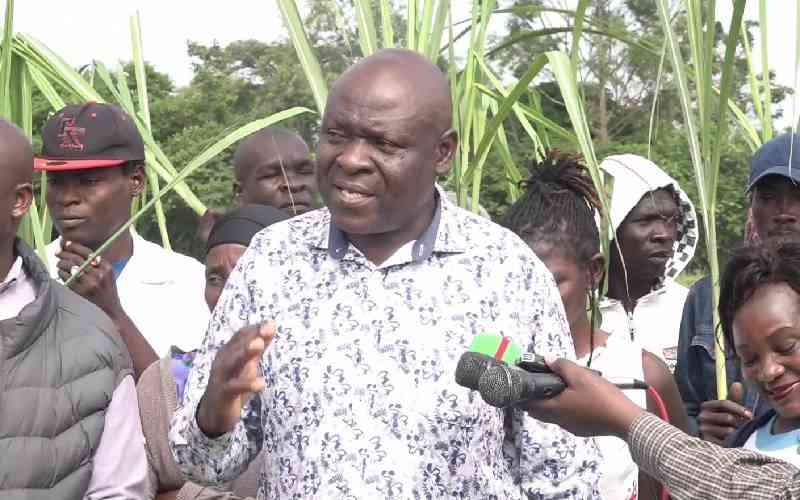

The decision came just a day after farmers held violent demonstrations outside the sugar miller's premises in a desperate bid to evict the management, for failing to pay them for delivery of cane.

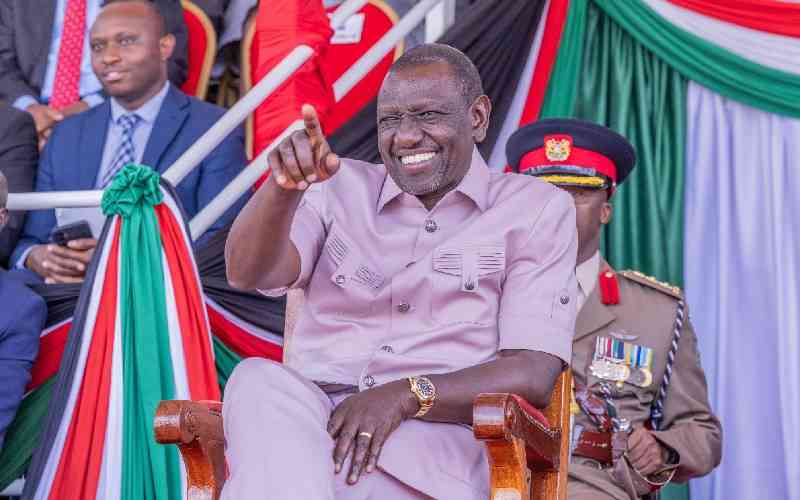

The turnaround will involve weeding out “sugar brokers” who have made the prices of sugar from the company uncompetitive. The deal hammered in a meeting chaired by Deputy President William Ruto in his office will see more than half of the board sent home and the entire management changed. Audit firm KPMG has been appointed to oversee the restructuring that will involve a rights issue which is expected to inject Sh4 billion into the cash-strapped firm.

Mr Ruto (pictured) announced the measures after chairing a meeting attended by National Treasury Principal Secretary Kamau Thuge, Mumias Board chairman Dan Ameyo, Chief Executive Officer Coutts Otolo and representatives of creditors. “We have taken these measures so that farmers in the region can be paid for delivery of cane,” Ruto said.

The announcement of the bailout comes on a day Mumias annual report provided a depressing picture for shareholders. The company sunk into deeper first-half loss of Sh2.08 billion against a restated loss of Sh407.4 million loss a year earlier.

Mumias, whose sugar output accounts for about a third of Kenya’s annual output, announced net revenues for the period ending December 1, 2014 fell 62 per cent to Sh2.67 billion. The miller attributed the loss to an unscheduled and out of crop maintenance of its factory located in western Kenya in October, November and December due to cane shortage.

“The revenues were impacted by the production time lost during the two and half months maintenance shutdown as well as cane shortage and lower average net cane price per tonne of sugar realized during the first quarter,” the company said in a statement.

The revenue from power exports and ethanol sales were down 33 per cent and 23 per cent respectively than the previous year due to challenges relating to availability of raw materials as well as adverse effect of the shutdown, it announced.

Emblematic of a crisis

The firm observed that low sugar production, high production costs and low prices resulting from illegal sugar imports further compounded the company’s half year results. Despite the challenges, it said, the company was looking forward to better performance in the second half of the year following successful resumption of production.

The restructuring starts in earnest with the board directed to notify shareholders of an Annual General Meeting and appointment of the audit firm. Mr Ruto said the Government will release Sh1 billion within a week when the audit firm is on the ground. The funds will be used to pay farmers outstanding arrears and put the company back on its feet.

However, he requested members of the board to voluntarily resign for failing the company or they will be phased out. The decision was reached after month-long consultations among lenders, the board, management, and the Government. Mr Ruto said the sugar company has to provide farm inputs at the right price and also sell its sugar at competitive price.

The state of the sugar miller is emblematic of a crisis in the sugar industry. A 29-member parliamentary committee on Agriculture is currently meeting in a Mombasa hotel to put the final touches to the sugar industry report that has been pending for months. House Speaker Justin Muturi last week ordered the committee to hand in their final report “without further delay”.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.