×

The Standard e-Paper

Kenya’s Boldest Voice

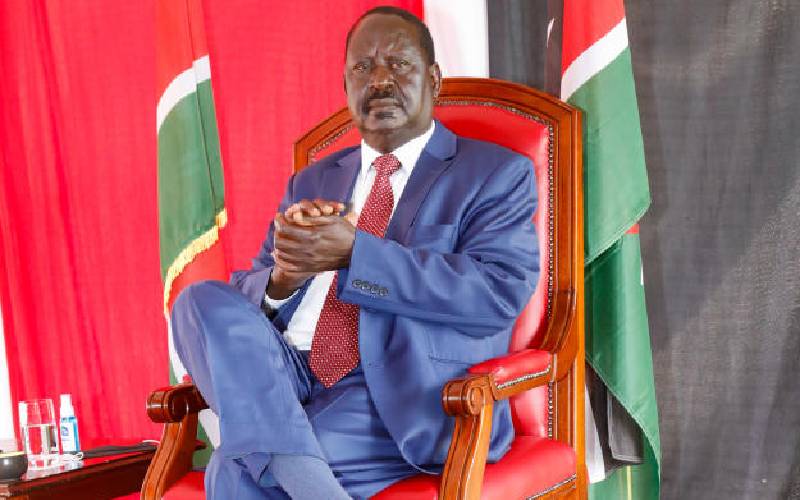

The proposal by ODM leader Raila Odinga to provide Sh6,000 for each poor family per month so that nobody sleeps hungry has sparked a debate on how it can be implemented if he were to be elected president next year. What would need to be done for such a bold proposal to be delivered cost-effectively for the benefit of Kenyans? I will address the “how” of social protection in this discourse.