×

The Standard e-Paper

Smart Minds Choose Us

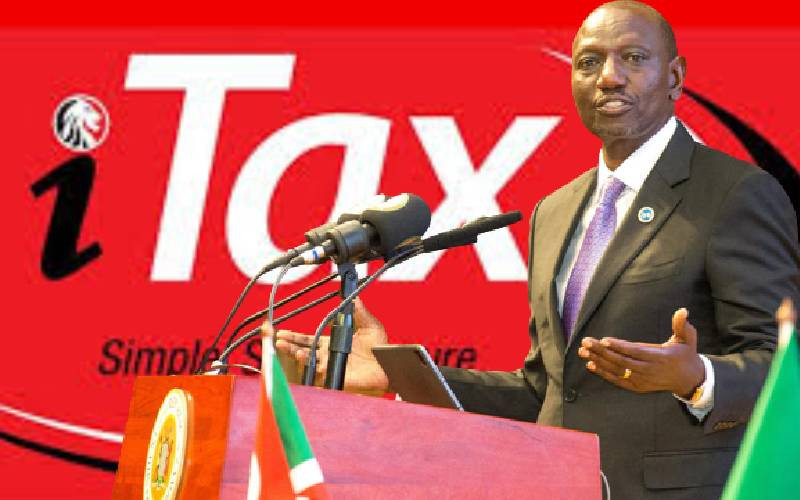

This week Treasury Cabinet Secretary Njuguna Ndung'u will present the budget statement to Parliament. The Sh3.6 trillion budget is President William Ruto's maiden one and will be funded through a mix of tax revenue and debt.

The Finance Bill - which sets out the revenue-raising measures for the Government - is set for debate in Parliament in the coming days and should be completed by June 30.