×

The Standard e-Paper

Home To Bold Columnists

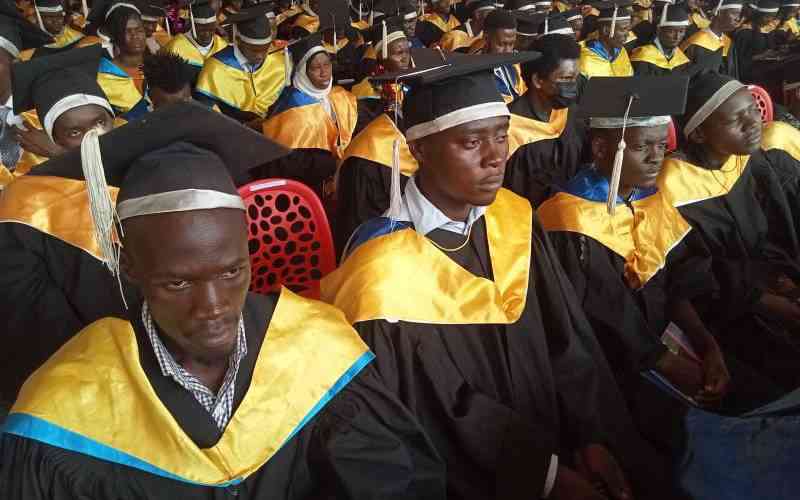

Elected leaders contribute a big chunk of defaulters to the Higher Education Loans Board (HELB) crippling its operations and killing many student's careers.

HELB chief executive Charles Ringera told MPs that the Fund is struggling to collect money from honourable legislators, making it difficult for other needy students to advance their studies.