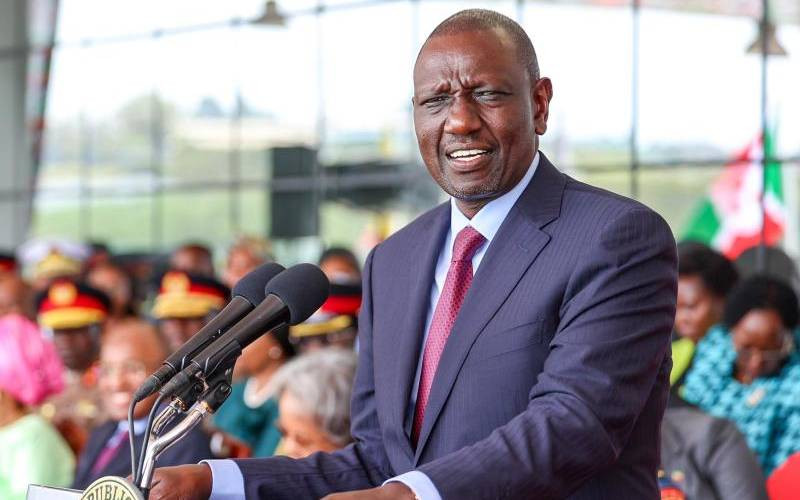

It was clear from our vantage point at the recent Future Investment Initiative (FII) conference in Riyadh, Saudi Arabia that foreign investment can revitalise the Kenyan economy. But how does President William Ruto make the East African economic lion to roar?

He needs to position Kenya as the investment hub for East Africa; the continent's preeminent profitable destination for global investment. This can only be accomplished with a carefully orchestrated, brand-focused marketing campaign that raises Kenya's profile on the world stage.