×

The Standard e-Paper

Join Thousands Daily

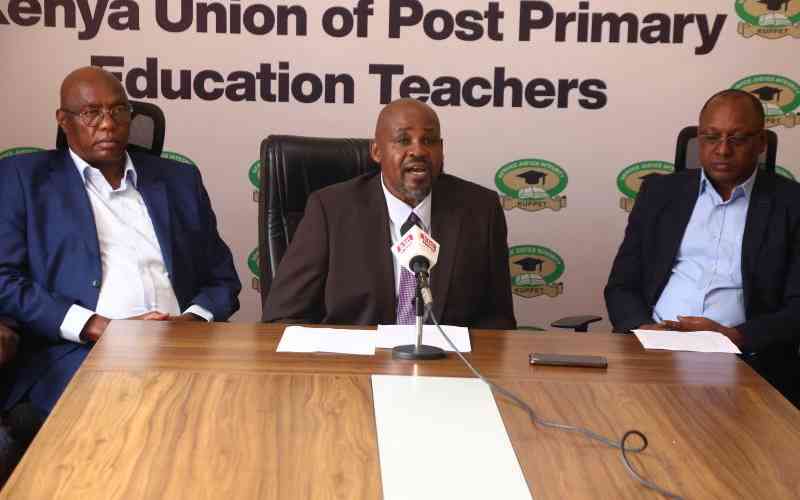

KUPPET Deputy Secretary General Moses Nthurima addressing the press over the government's proposal to deduct civil servants' 3 per cent salary for housing on April 26, 2023. [Silas Otieno, Standard]