×

The Standard e-Paper

Kenya’s Boldest Voice

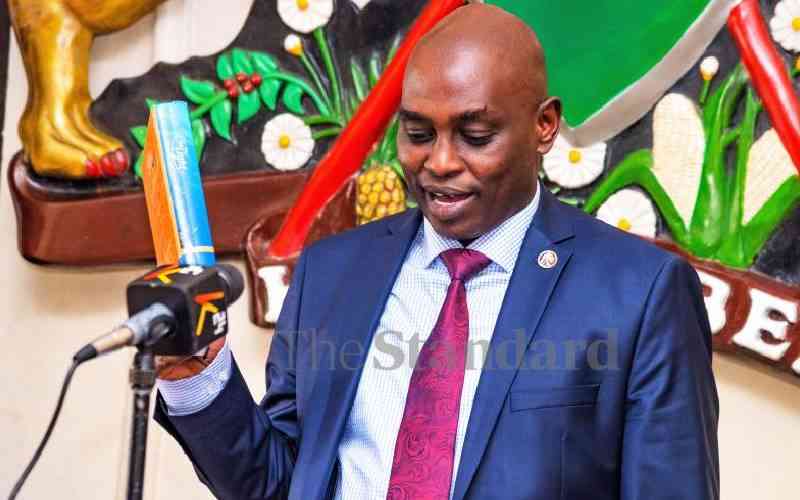

Kenya Revenue Authority (KRA) board chairman Anthony Mwaura has said that his team has embarked on cleaning up the tax collector.

Mwaura vowed to professionalise the revenue authority before the end of the year.