×

The Standard e-Paper

Stay Informed, Even Offline

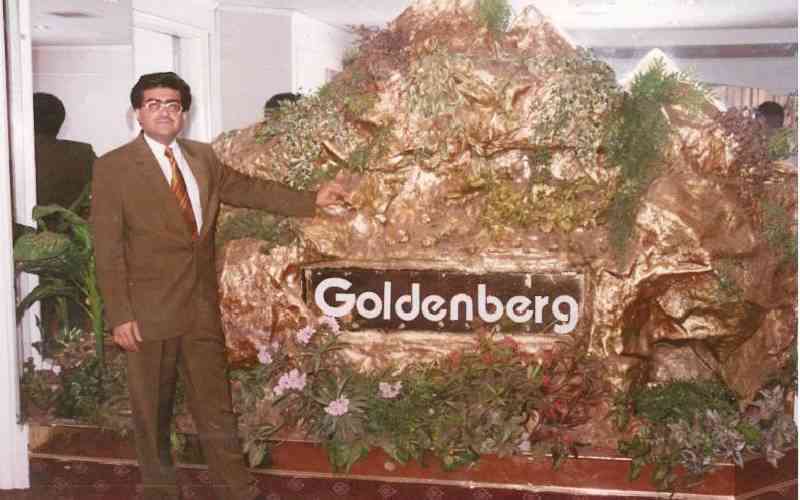

Kamlesh Pattni at his Goldenberg Company in Nairobi. [File, Standard]

It was dark and extremely cold as he groped his way around. The room was stuffy and smelling of dust. A few false misses, and he eventually landed at the public gallery, upstairs.