×

The Standard e-Paper

Stay Informed, Even Offline

Late last year, during a meeting with President William Ruto, pension sector stakeholders revealed an elaborate plan to lower the cost of housing by 30 per cent.

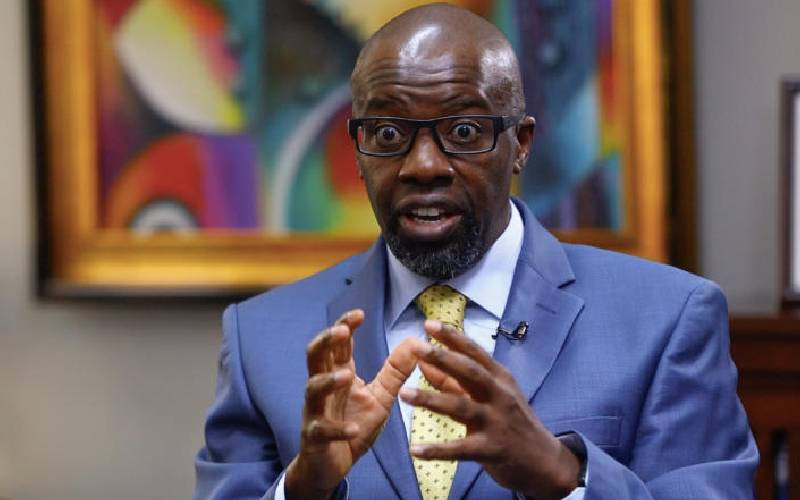

This reduction, as argued by Liaison Group Managing Director Tom Mulwa, would be made possible through six enablers tabled to the government and set to smoothen financing for investors in the housing sector.