×

The Standard e-Paper

Stay Informed, Even Offline

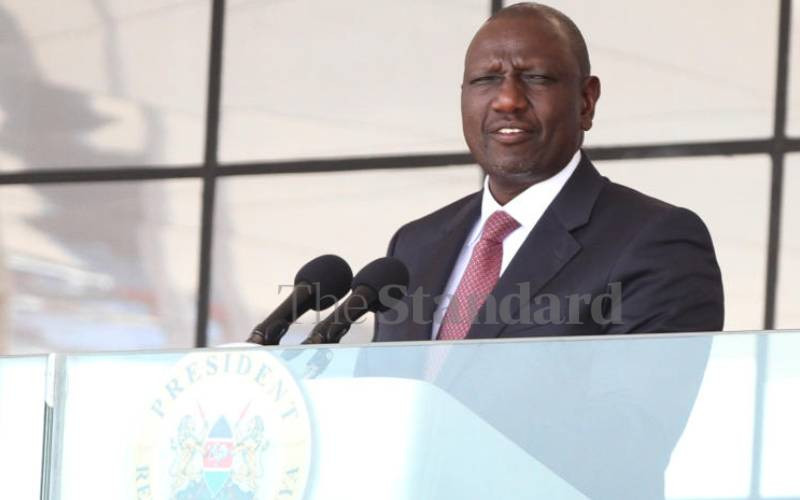

President William Ruto wants Kenya Revenue Authority (KRA) to increase tax collection, up from Sh2 trillion in 2021/22 to Sh3 trillion by next year.

He urged the taxman to double the amount to Sh6 trillion by 2027.