Audio By Vocalize

If you are among those individuals who are so afraid of Kenya Revenue Authority (KRA), there is no need to continue harbouring that fear.

Julius Yiega KRA chief manager taxpayer services, domestic taxes department who is also in charge of taxpayer education says a lot of culture change has made KRA to be friendly.

The adoption of technology has improved the way Kenyans can file their returns.

He notes that some time ago, at a time like this, there would be long queues of Kenyans struggling to beat the June 30, deadline.

It is no longer the case as now filing has been automated and reduced to a service you can complete on your phone through an application.

“When we came up with automation what was eliminated actually at KRA is corruption,” he says. “You can file your returns on your phone, more so if you have nil returns. You just go to the KRA M-Service app downloaded on Playstore.”

Yiega says the perception of a policing KRA is long gone as now the agency has rebranded from “do you pay taxes?” to ‘are you tax compliant?”

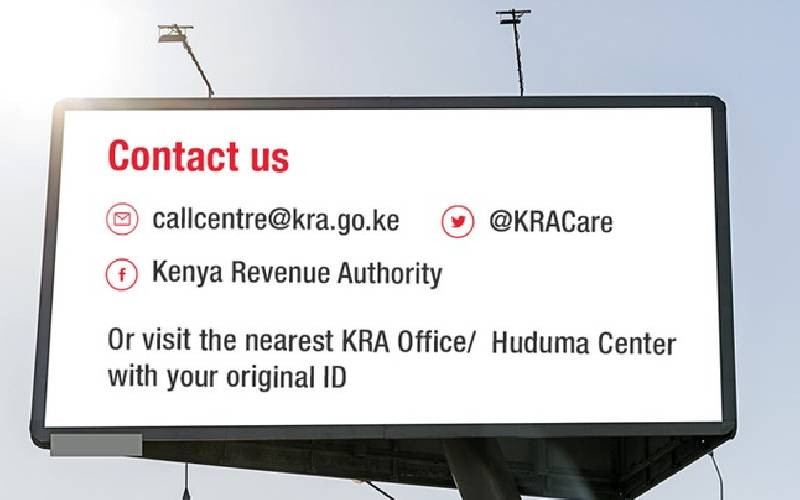

“KRA, contrary to a lot of opinions, is a friendly institution. We are here to ensure taxpayers have their rights,” he says. For any complaints or tax issues, one can reach KRA via [email protected] or [email protected] and you will be responded to.

An individual who does not file returns – even nil – is penalized Sh2,000 while a company gets fined sh20,000.

“But if you can prove with documentation (that you did not earn anything), KRA has a process of waiver, so it (penalty) can be waived,” says Yiega.

How to file nil returns on ITax:

How to file NIL returns on KRA’s M-Service:

Login using your M-Service App credentials.

Stay informed. Subscribe to our newsletter

You will receive a message confirming that you have successfully filed your NIL returns.