×

The Standard e-Paper

Smart Minds Choose Us

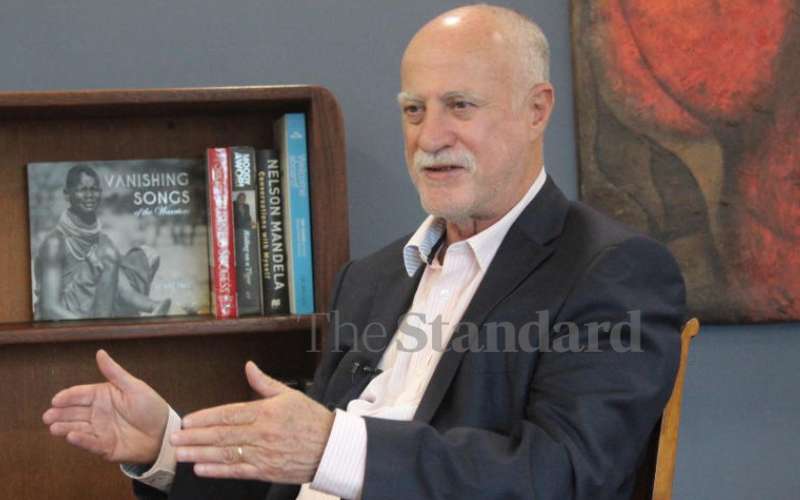

Safaricom Board Chairman Michael Joseph. He regrets the borrowing spree witnessed on M-Pesa linked lending products. [David Njaaga, Standard]

For all the good things M-Pesa has brought, Michael Joseph, the man who gave life to the transformational idea that won global praises has some regrets too; the borrowing frenzy.