×

The Standard e-Paper

Stay Informed, Even Offline

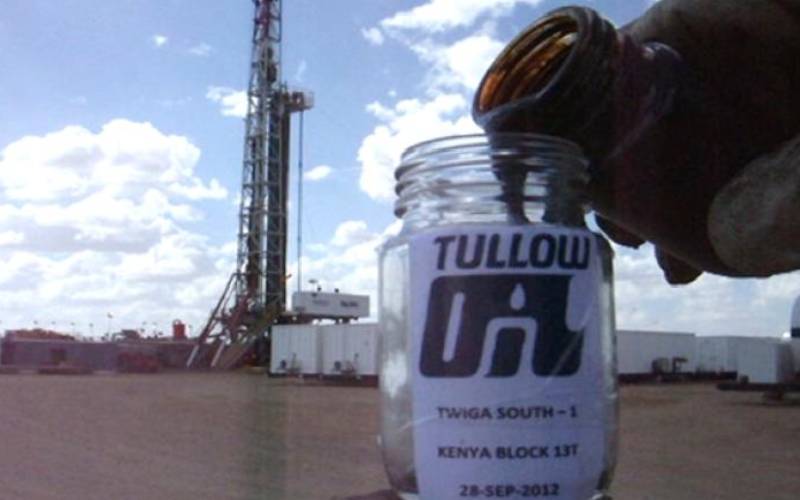

Tullow made an entry into Kenya in 2010 when it acquired a 50 per cent stake in the Lokichar oil blocks. [File, Standard]

Among the most enduring images in Kenya’s fledgling oil industry is that of former Energy and Petroleum Minister Kiraitu Murungi holding a bottle of a black substance that he declared was oil from Lokichar, Turkana County.