×

The Standard e-Paper

Stay Informed, Even Offline

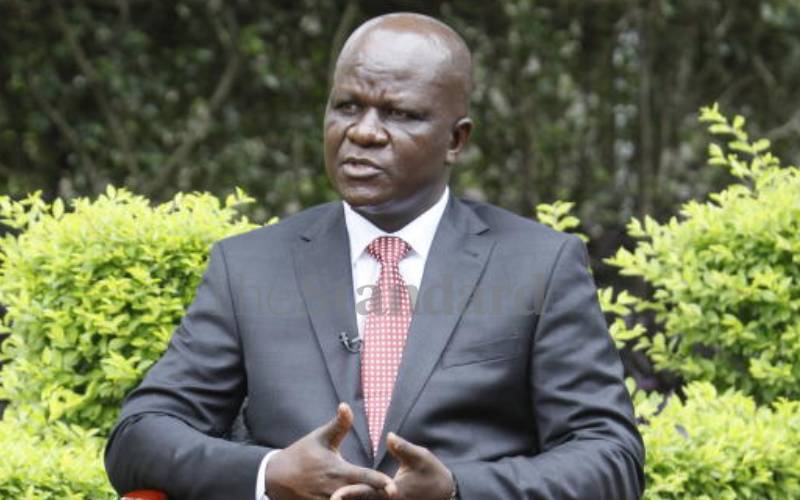

Kenya Union of Savings and Credit Co-operatives (Kuscco) Managing Director George Ototo. [Jenipher Wachie, Standard]

About 800 delegates are set to meet in Mombasa today for the seventh annual Saccos Leaders Convention. The meeting themed ‘Saccos Collaborate! The Clock is Ticking’, will be headlined by Agriculture Cabinet Secretary Peter Munya and Equity bank CEO James Mwangi.