×

The Standard e-Paper

Home To Bold Columnists

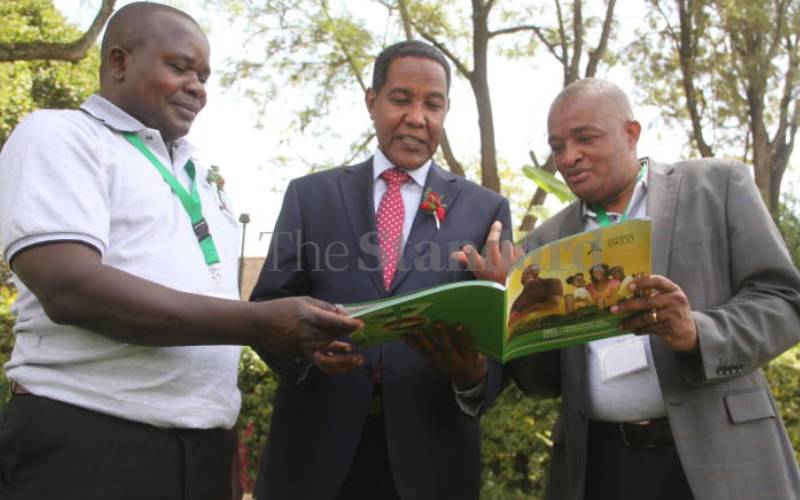

Harambee Sacco CEO George Ochiri (left), chairman Macloud Malonza and PS Ali Noor Ismail (centre). [Edward Kiplimo, Standard]

The rollout of the Credit Liquidity Fund, which allows Saccos to borrow from one another, will greatly help societies overcome temporary liquidity challenges.