×

The Standard e-Paper

Join Thousands Daily

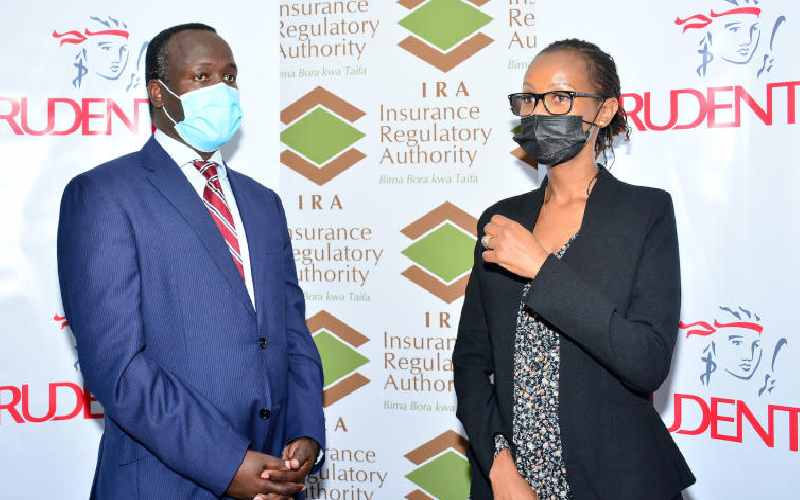

IRA Chief Executive Godfrey Kiptum (left) and Prudential CEO Gwen Kinisu. [Jenipher Wachie, Standard]

Three local startups have received Sh1.25 million each in cash awards from an innovation hub steered by the Insurance Regulatory Authority (IRA), in collaboration with Prudential Life Assurance Kenya and partners, to promote inclusivity.