×

The Standard e-Paper

Home To Bold Columnists

The subject of money is emotive and controversial, especially among Africans. It is the number one cause of conflicts in families and institutions.

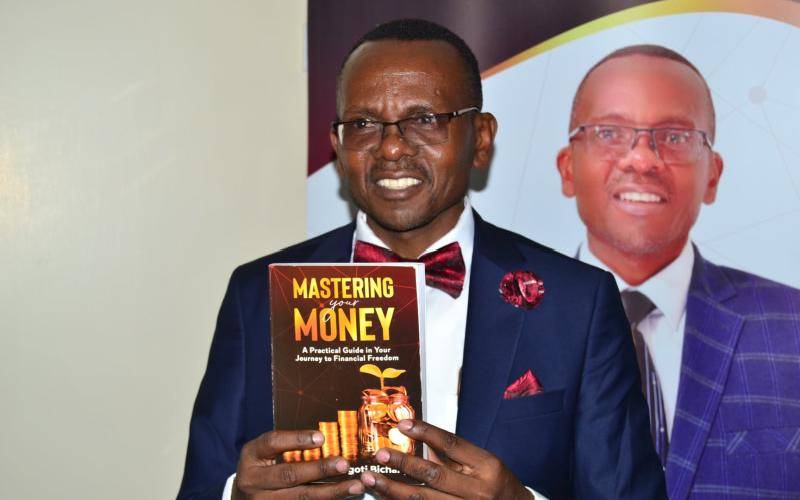

The big question however is: Why do many people experience many problems with money? Personal financial coach Chacha Nyaigoti Bichiang’a argues that the main root cause of financial problems is lack of financial mastery and literacy.