×

The Standard e-Paper

Smart Minds Choose Us

It was Nassim Taleb, the Lebanese-American scholar, who once opined that the curious mind embraces science; the gifted and sensitive, the arts; the practical, business; the leftover becomes an economist.

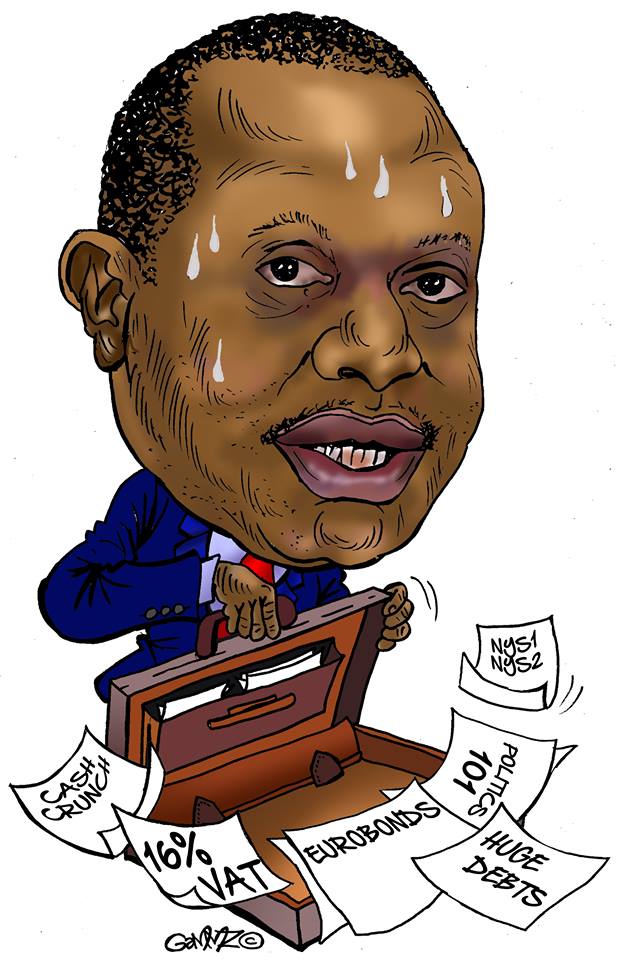

Apparently, Taleb could have unwittingly been talking about the managers of the economy in modern day Kenya, with Henry Rotich, the National Treasury cabinet secretary, being the high priest and Principal Secretary Dr Kamau Thugge the lead counsel.