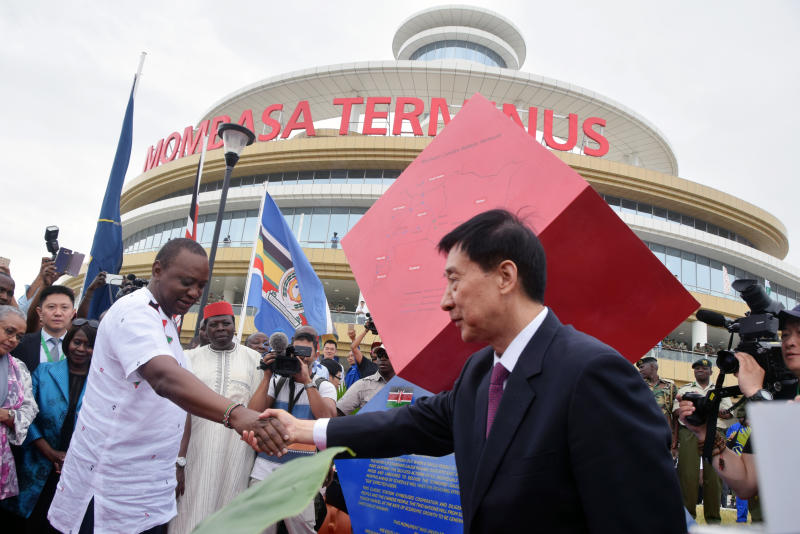

“China’s debt trap,” “honey trap” and “debt diplomacy” are some of the choice descriptions that China has earned from its “Belt and Road” initiative. The Belt and Road initiative is China’s description of its widespread and ambitious use of debt to gain influence across the world.

China’s willingness to lend to vulnerable countries, coupled with its hardball approach to debt collection in countries unable to meet their debt obligations, is now a cause of global concern. China, like Shylock in Shakespeare’s Merchant of Venice, demands no less than a pound of flesh from any country that is unable to repay its debts.