×

The Standard e-Paper

Kenya’s Boldest Voice

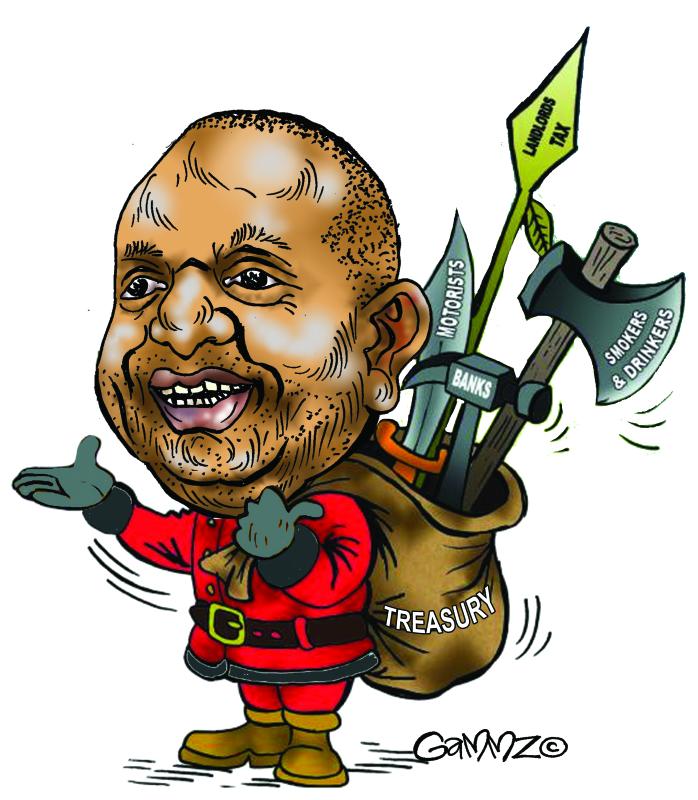

Cash-strapped and desperate, President Uhuru Kenyatta’s Government is now lunging at everyone in its path and emptying their pockets in a frantic bid to finance the country’s expansive budget.

Last week, Cabinet Secretary Henry Rotich read a budget statement which painted a picture of a cash-hungry Treasury willing to mobilise revenue by every means, even hitting hard innocent taxpayers who might have a genuine explanation for delaying to file tax returns.