NAIROBI: The assent to the bill capping interest rates has been hailed as a game-changer by the public. And indeed it is, if the meltdown at the stock exchange is anything to go by.

This is one of the immediate effects of the bill. The real impact on the economy, on group and individual financial behaviour will come later. Often, the actual effects of such measures take time to register.

However, the Government could go further to enable more people access low cost credit. Some of the more sustainable solutions would be, first, that the fight against corruption must not be abandoned.

There is so much money going into private pockets that if a fraction of it is tapped and channelled to restructure financial institutions, then we won’t even need bank loans.

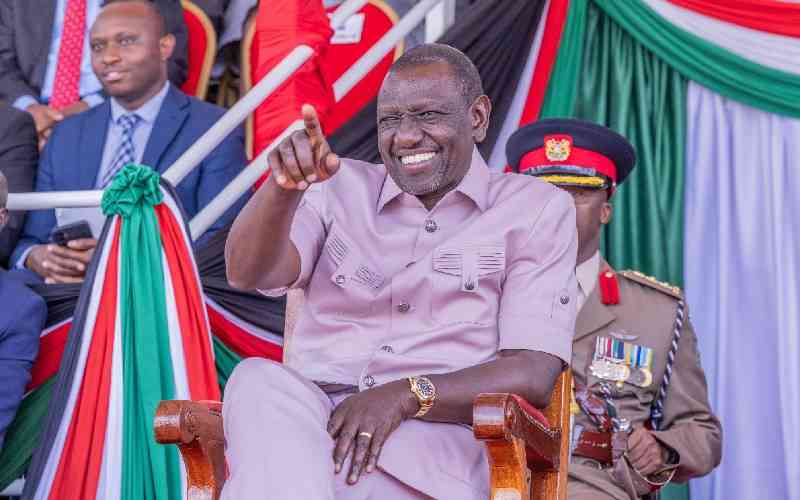

If President Kenyatta can rein in roguish banks’ lending, surely, he can purge these moth-bound institutions: the Women Enterprise Fund, the Youth Fund, the Micro Enterprise Support fund, the Kenya Industrial Fund etcetera.

If by miracle, possible through political good will, President Kenyatta streamlines procurement and tendering systems in the Government, the money saved would be more than enough to lift the majority of Kenyans from poverty. Secondly, the Government could do more to rein in banking cartels.

Do not underestimate the capacity of the banks to fight back through implementing hard-to-fulfil conditions for personal loans.

Already, they were quick to suspend unsecured loans. Of course this is more panicky than strategic decision.

Even if banks don’t lend directly to low-income earners, innovative Saccos and micro-finance institutions (MFI) could borrow low from banks and sell to their clients. There is a strong case for strengthening the Saccos and MFIs. Thirdly, the Government should seriously rein in its appetite for domestic borrowing. The Government has the mechanisms to seek low rates offshore.

Government’s sharp taste for local credit has been blamed for the bank’s disdain for small borrowers. If this is reduced, the banks would have no alternative but to offer poorer Kenyans better terms.

It is good that the Uhuru government realised early in the term the need to strongly move away from depending on domestic borrowing to finance government expenditure. Despite the Eurobond shenanigans, it is still the best indicator of the right trend for the Government.

If private banks become headstrong (and who will they eventually be lending to anyway?) the Government can resort to arm-twisting.

Is it possible for the Government to fully take over KBC or National Bank and then use them to implement socially friendly financial policies, like low interest loans?

Fourthly, perhaps MFIs and banks should strictly offer loans for investment only. When people get more disposable incomes, they tend to spend them on consumption. There is nothing wrong where manufacturing is strong. Currently, we are importing most of our consumer goods mainly from Asia.

Stay informed. Subscribe to our newsletter

In a country with a big appetite for imported goods, lower interest rates could lead to more demand for consumer goods.

This could strain the weak shilling. There is already a huge export-import deficit; we are dangerously importing more than we export.

Worse, many of us are neither trained in personal financial management nor have the discipline to manage sudden rise income. This euphoria on rates will add to rising confidence in the country, leading Kenyans to spend more in ‘ feel nice’ goods; expensive clothes, cars etc. In theory, lower interest rates should encourage investment. Certainly some will borrow to invest in manufacturing and services. Good for the economy.

But there are precedents where Kenyans suddenly had windfalls and went for a spending spree.

In 1977, bad weather hit Brazilian coffee farms, leading to acute coffee shortages on the world market.

Kenyan coffee prices shot through the roof. This created instant coffee tycoons in the villages. Some small-scale farmers were wise enough to buy extra land or start income-generating projects.

But there are many more who did the easiest thing; they bought personal cars, built stone houses, or acquired expensive habits like drinking.

The wreck on families was noticeable as the more socially enterprising fellows acquired extra wives or ‘sponsored’ mistresses.

In the 2000’s, banks and micro finance institutions made it easier to get credit. Middle and low-income earners had sudden access to credit.

Teachers, nurses, civil servants went for ‘soft’ loans and everyone had a personal car, latest LCD TV sets, made in China sofa sets and suits. Result? We are one huge Chinese supermarket.

In all, radical changes in one sector without addressing other factors may not necessarily have meaningful impact on the lives of the general public.

One reason why we seem to be in an illusion of economic movement without concrete change in livelihoods is because policy changes are incoherent and disjointed.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.