Things just got a little tighter at the counters—anyone withdrawing or depositing more than a Sh1 million (or $10,000) will be required to fill in a special form stating where the money is from or is going, who they are paying or receiving the money from and for what purpose, either way.

This is one of the rules contained in the latest Central Bank of Kenya (CBK) guidelines in a raft of new measures that experts say are meant to increase traceability of bank transactions by encouraging those undertaking huge transactions to use electronic means.

“While most cash transactions are carried out in legitimate business, large cash transactions which are characterised by informality and anonymity make bank transactions vulnerable to money laundering and terrorism financing,” said the circular entitled Additional Guidelines to Large Cash Transactions.

CBK has a game plan of curbing money laundering, taming fraudulent money movements, while zeroing in on those financing corruption, criminal and terrorism activities.

Already, many of the commercial banks operating in the country have issued notices to their customers informing them of the new rules and made arrangement for special forms to be filled in case they want to withdraw cash in excess of Sh1 million.

“We will capture the information above through a mandatory declaration form available for eligible transactions. The guidelines are in line with the Proceeds of Crime and Anti-money Laundering Regulations, 2013 and take effect immediately,” states a notice issued to bank customers.

“The new mandatory guidelines are aimed at making the payment systems secure and reduce losses due to fraud and theft while providing an audit trail that makes funds traceable in case of any eventuality.”

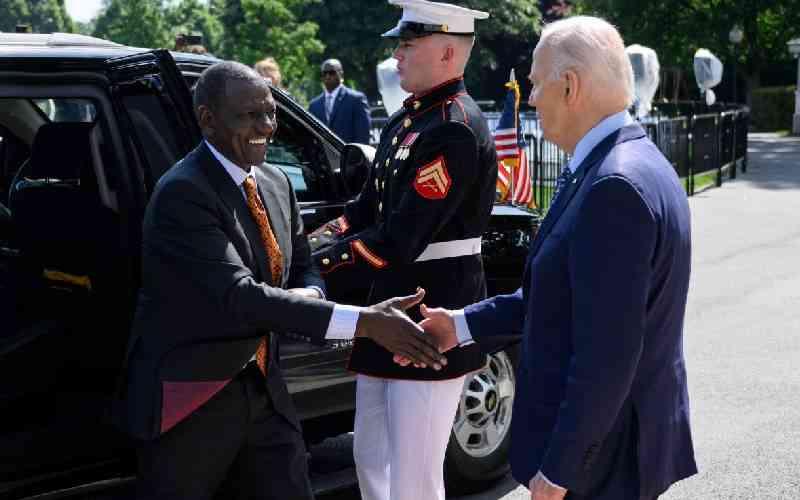

This follows the coming into effect of an agreement between Kenya and the Obama administration where Kenya agreed to share every financial transaction that is above Sh1 million.

In the agreement, the information, which financial institutions, cash dealers and professional bodies are under obligation to submit regularly to the Financial Reporting Centre (FRC) — under the Proceeds of Crime and Anti Money Laundering (Amendment) Act, 2012 — will also be circulated to other countries.

Under the new regulations, a customer will be required to state where they are taking the money, for what use and in addition justify why they are not using electronic transfer options. Among the questions that will have to be answered include, why the large cash deposit or withdrawal is necessary, why it cannot be done through electronic means, the source of the funds, the full identity of the intended beneficiaries of the money and a controversial one: where the money will be taken immediately after leaving the bank premises.

While many have taken the move in a positive light given the ability of the process to tame corruption, financing terrorism, fraudulent money transfer, questions are being raised as to whether the prescription is the most efficient and foolproof way of handling such concerns.

Social media was abuzz over the proposal, with many people asking for clarification and adjustments to the new rules and regulations so as not to inconvenience legitimate business people and citizens. George Obulutsa: “What if it is a gambler wishing to withdraw his or her money? Do they have to say which casino? I’m also looking forward to politicians filling in bank forms next year for campaign cash.”

Johnson Nderi an investment banker said that the government can monitor concerns of money supply through open market operations. Nderi also wondered if the privacy rights of customers were being violated with such a rule.

Sectors that will be affected by the directive include investors who regularly deposit and withdraw money in bulk such as retailers and those in the construction industry.

The regulation will apply to the 33 million bank account holders in Kenya.

Stay informed. Subscribe to our newsletter

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.