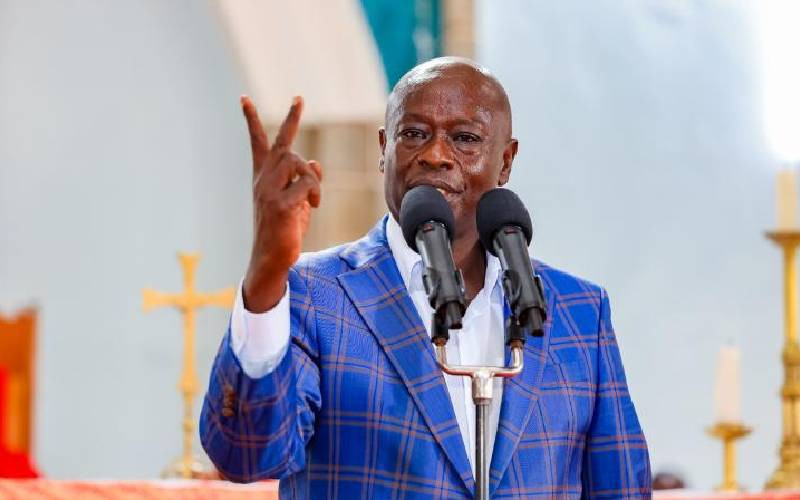

The Treasury is set to review the excise tax slapped on beer made from sorghum, millet and cassava two years ago, causing a plunge in sales and massive losses to farmers, Cabinet Secretary Henry Rotich has said.

The 50 per cent levy dealt a blow to East African Breweries Limited’s (EABL) fastest growing product, Senator Keg.

Monthly sales of the brand plummeted from 20 million litres to about three million litres, following a sharp increase in the price of the drink triggered by the tax.

It also affected 60,000 farmers from arid and semi-arid regions of the country who had been contracted by the brewer to grow sorghum to feed the manufacture of Senator Keg.

The farmers lost up to Sh3.4 billion last year as huge stockpiles of sorghum went to waste because of depressed demand by the brewer.

Lower or scrap

Industry stakeholders have been pushing the Government to either lower or scrap the 50 per cent levy introduced on the low-cost beer during last year’s Budget Speech.

The Treasury boss did not, however, indicate whether the tax would be totally scrapped or reduced.

“What is certain is that we will announce new measures. Right now we are exploring whether there are other options we can employ to make the situation better for everyone,” said Mr Rotich.

He declined to state what options Treasury was considering, saying that would amount to disclosing the contents of the next Budget.

Business Beat could not reach EABL’s Group MD Charles Ireland for comments, but an earlier email from the company’s corporate affairs department acknowledged that Senator sales had dropped massively.

“The increase in taxes on Keg has adversely affected affordability of the Senator product, with a significant drop in volumes. As a result, the corresponding business demand for sorghum has been severely affected,” stated EABL.

“This, in turn, affects the thousands of farmer livelihoods that the crop has supported over the last years.”

Research conducted by thinktank Tegemeo Institute indicates that EABL’s participation in the sorghum market boosted grain production to 12,715 tonnes in 2012 from a low of 474 tonnes.

Rotich’s disclosure has brought hope to a number of farmers who have been lobbying the State to reduce the tax to spur demand for the beer, whose key ingredient is sorghum.

Stay informed. Subscribe to our newsletter

“We pray the tax is scrapped totally. We have been suffering because we have huge amounts of sorghum in our stores that we cannot sell or consume. Removal of the tax will greatly assure us that the Government has our interests at heart,” said Silas Mutinda, a large-scale sorghum farmer based in Lower Yatta, Kitui County.

The reality

The tax was imposed to help the Government shore up its revenue base, partly to plug the yawning gap between what it is collecting in earnings and what it is spending.

Rotich indicated the State was targeting to collect Sh6.2 billion from the new tax during last June’s Budget reading, but statistics indicate the current volumes will not yield even Sh1 billion.

The reality on the ground has led to questions about why the tax was introduced in the first place.

Sorghum farmers, transporters, distributors and other players in the value chain have lost massive amounts of money following the introduction of the tax on Senator Keg beer.

“In terms of policy, the tax measure is like a zero-sum game — giving with the right hand and taking away with the left,” said James Shikwati, the director of economic policy think tank Inter Region Economic Network (Iren).

“If the reports we hear about dropping sales of mainstream low-end beer are true, then we should prepare for a major reversal in the gains made against the fight on illicit brews.

“It doesn’t mean that more people have quit drinking, but is a pointer to the relapse of a large population who have gone back to dangerous brews. This should get any government worried.”

The back and forth about the Senator tax has elicited discussions on how far corporates should trust a government with their investments, especially in a business environment where policy decisions change at the snap of a finger.

Closer scrutiny of how Senator Keg came to be indicates the Government may have reneged on a policy issue whose discussions started in 2004.

Hansard excerpts

The conversation began after the Government approached EABL to help solve the problem of illicit brews when several people died after consuming illicit brews.

Excerpts from the Hansard show that the Government, through then Finance Minister David Mwiraria, asked EABL to help find a solution to the problem of these brews.

“I have, in separate discussions, challenged EABL to manufacture a beer, which would compete in price with chang’aa, but which would be safe to drink. I am glad to say that it is almost making a breakthrough, and that a new drink called ‘Senator’, which will only be sold in chang’aa dens, will soon be available in the market,” Mwiraria told Parliament during proceedings recorded on November 1, 2004.

So why did the State renege on a deal it pushed EABL to come up with? Rotich said imposition of the tax was not meant to punish low-end beer consumers, but happened after the keg beer started to attract people it was not meant for.

“Senator was initially targeted at those who consume illicit brews, but it began to attract high-end consumers. This means the Government began losing revenue and part of the reason the tax was introduced was to stop revenue leakage,” said Rotich.

Food security

Some high-end consumers may have started to drink Senator, but looking at the geographical spread of the outlets that sold it and the manner in which it was being dispensed, one gets the feeling that while the tax targeted the minority high-end consumers, it also punished the low income earners who were the majority consumers.

Caught in the crossfire are about 60,000 farmers, some of whom invested heavily to grow sorghum with the promise of a ready market and buyer in the name of EABL. Most of the farmers were persuaded by the State through institutions like the Kenya Agricultural and Livestock Research Organisation (Kalri) to venture into sorghum farming, a crop that is not only suitable for arid and semi-arid areas, but would also offer better food security.

The total investment by all players, including the State, in the whole process is estimated to be more than Sh10 billion.

Statistics from the brewer indicate there were 12,000 distributors of the keg beer before the implementation of the new tax. Out of these, 7,500 have closed down and are yet to revive their outlets. This has translated to job losses for an estimated 100,000 people.

The fact that the State will not collect even Sh1 billion from the target it had set from the tax measure has seen stakeholders question if the tax was necessary in the first place.

“They (the Government) should probably think of allocating more money to treat health problems and build more rehabilitation centres for alcoholics to mitigate the problems that will arise as a result of consumption of illicit drinks and the new policy. In my opinion, the end result of raising taxes on low-end beer is predictable,” said Shikwati.

Rotich acknowledged that something needs to be done to sort out the confusion on Senator Keg.

“We have had discussions with industry stakeholders, which are ongoing, and we will find a solution,” he said.

[email protected]

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.